In key news on German stocks, Siemens Energy AG (DE:ENR) is reportedly investing €1.2 billion to expand its electricity grid division amid the ongoing challenges in its wind turbine business. As reported by the Financial Times, the company will also hire 10,000 new employees over the next six years, with 40% of these jobs to be based in Europe. Siemens Energy shares have gained nearly 5% as of writing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Over the last year, ENR stock has seen various ups and downs, as the company’s troubled wind business weighed on investor confidence. Nonetheless, during its Capital Markets Day in November 2023, the company unveiled its plan to achieve breakeven in its struggling wind turbine unit by FY26. Year-to-date, ENR stock has gained 110%.

Siemens Energy is a global company that designs and operates various energy systems, including wind and gas turbines, gas engines, steam turbines, and power distribution systems.

Siemens Expands Amidst the Global Power Sector Surge

According to Tim Holt, head of Siemens Energy’s Grid Technologies, research indicates that over the next 15 years, power companies would be required to make massive investments in the electricity grid business, with the amount matching the investments made over the last 150 years. The growth in the power sector will be primarily driven by the surging demand for electricity, the need for infrastructure upgrades, and higher demand for grid connections in renewable energy projects. Consequently, the company aims to capitalize on this opportunity.

Holt also stated that the company is already witnessing a surge in its grid unit’s orders, which have doubled from €7 billion in 2021 to €15 billion in 2023. The orders reached €12 billion in the first half of 2024.

The €1.2 billion investment will be dedicated to new factories and improved manufacturing capabilities in the U.S., Europe, and Asia.

Is Siemens Energy a Good Stock to Buy?

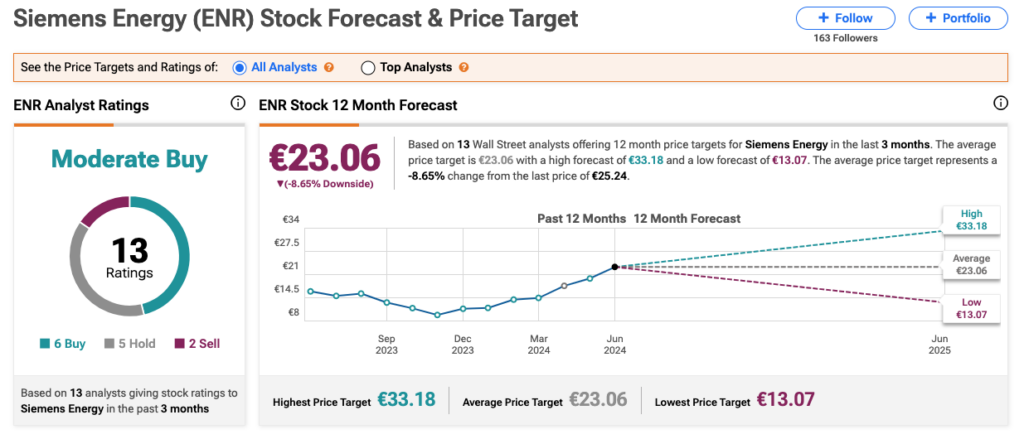

On TipRanks, ENR stock has a Moderate Buy consensus rating, backed by 13 recommendations, of which six are Buy. The Siemens Energy share price forecast is €23.06, which implies a downside of 8.65% from the current level.