According to analysts, the share price of the SGX-listed leisure company Genting Singapore Limited (SG:G13) offers 30% upside potential. Over the last three years, the stock has recovered and gained more than 40%. This was in line with the recovery of its business operations after being hit by the pandemic.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moving forward, analysts hold a bullish view of the company and the stock as tourism and airline capacity rebound. Analysts expect the company to gain further momentum in the second half of Fiscal 2023 and see the current valuation as fair.

Genting Singapore is an investment holding company engaged in the development of resort and casino properties. The company is a prominent name in global leisure, hospitality, and integrated resort ventures.

Let’s take a closer look at it.

Strong Numbers

In August, the company published its first-half earnings for 2023, with a strong recovery in sales across all its segments. During the period, the company’s revenues grew by 63% to SG$1.08 billion. Also, its net profit surged to S$276.7 million, marking a substantial growth rate of 228% compared to the first half of 2022.

The stock also ticks the box for income investors with its dividend yield of 4.1%. Following its robust first-half earnings in 2023, the company increased its interim dividend by 50%, raising it from S$0.01 to S$0.015.

This year, the company expects its EBITDA to grow by 29% to S$997 million compared to 2022.

Analysts’ View

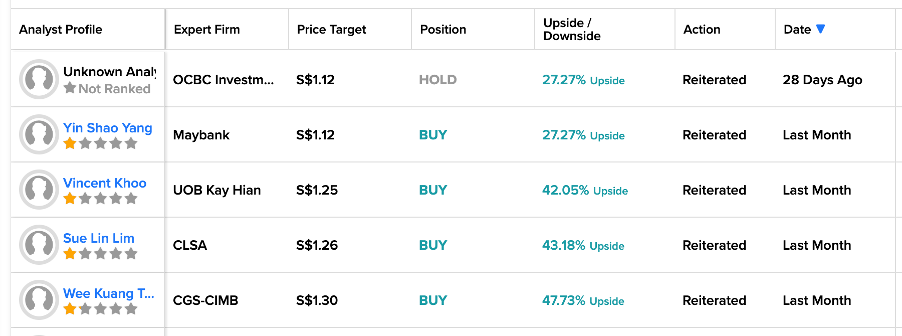

Following the positive set of results, many analysts have maintained their Buy recommendations over the last month, predicting more upside.

Analysts believe that as China continues its efforts to gradually reinstate air travel, its flight capacity will further increase to reach approximately 70%-80% of 2019 levels in the second half of 2023 from the current level of 50%. Genting is in a favorable position to capitalize on the upsurge in air capacity and tourism influx to Singapore, with a particular focus on visitors from China.

What is the Price Target for Genting Singapore?

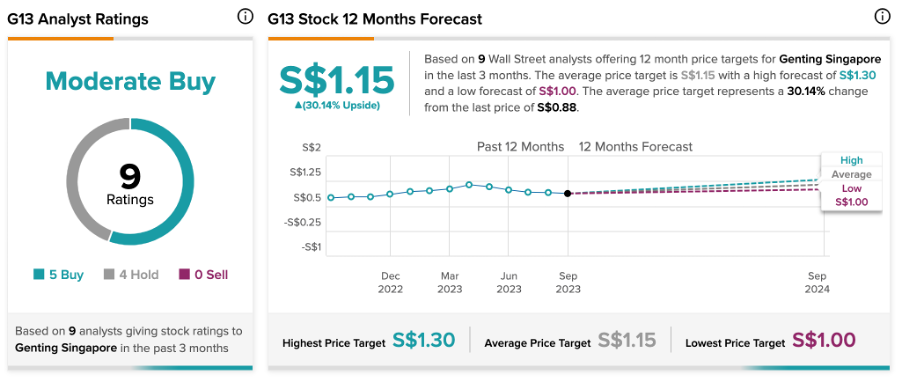

G13 stock has received a Moderate Buy rating on TipRanks, backed by five Buy and four Hold recommendations. The Genting share price target is S$1.15, which is 30% higher than the current trading level.