Italian stocks ENI S.p.A. (IT:ENI) and Intesa Sanpaola S.p.A. (IT:ISP) are famous for their dividends and could be worth considering for generating passive income. Both of these stocks carry a dividend yield of more than 6%. Also, analysts expect dividend growth to continue in the near future.

In terms of share price appreciation, ISP has a Strong Buy rating from analysts, with a projected 35% increase in its share price. For ENI, analysts exhibit a more moderate bullish sentiment towards the stock, anticipating a 19% uptick.

Let’s take a look at these companies in detail.

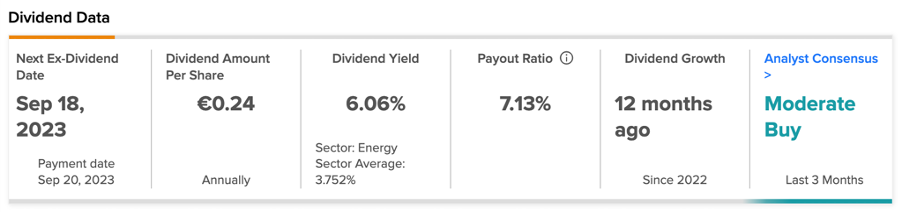

ENI Dividend 2023

Eni is an Italian energy company that focuses on activities related to the exploration and extraction of crude oil, natural gas, and condensates. The company has operations in 69 countries worldwide.

The company has an impressive dividend yield of 6.06%, much higher than the sector average of 3.75%. The company has disclosed its intention to allocate 25-30% of its cash flow to dividends and share repurchases. Eni has further declared that for the year 2023, it plans to boost its dividend by 7%, resulting in a dividend per share of €0.94. This is higher than the dividend of €0.88 paid for FY22. It also announced a share buyback of €2.2 billion for 2023.

The initial payment of the 2023 financial year’s dividend is scheduled for September 20, 2023.

Is Eni SpA a Good Buy?

Analysts are bullish on the stock thanks to a blend of well-informed management choices, favorable market conditions stemming from recent OPEC+ agreements, and a dominant position within the oil market.

According to TipRanks, ENI stock has a Moderate Buy rating based on seven Buy and three Hold recommendations. The ENI share price forecast is €17.40, which has an upside of 19% on the current price level.

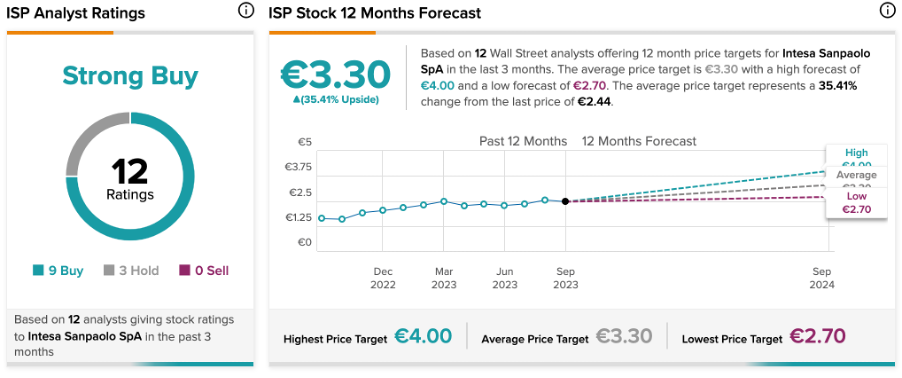

Intesa Dividend Date

Intesa Sanpaola stands as Italy’s largest banking group, boasting a global presence that extends across Europe, Asia, the United States, and Africa.

According to the company’s 2022-2025 business plan, the cash dividend distribution aligns with a yearly payout ratio of 70%, calculated based on the consolidated net income for each year of the plan. At a dividend yield of 6.71%, Intesa looks like an appealing option for investors. In 2022, the company paid a dividend of €0.164 per share, for a total distribution of €3 billion. For 2023, analysts are forecasting a dividend of €0.29 per share and a yield of 11.4%.

In its Q2 earnings report released in July, the company also revised its annual forecast for 2023 upward, driven by higher interest rates. Intesa now anticipates that its full-year profit for the year will significantly surpass the previous projection of €7 billion, and it also envisions additional growth in 2024 and 2025.

Intesa Sanpaolo Share Price Target

According to TipRanks, ISP stock holds a Strong Buy rating, supported by nine Buy and three Hold recommendations. The Intesa share price target stands at €3.3, indicating a significant 35.5% increase from the current trading level.

In the last 12 months, the stock has witnessed a significant surge of 55.2%.

Conclusion

Investors focused on generating a steady income from dividends will find appealing options in Italian shares such as ENI and ISP. Both of these companies benefit from robust market positions and enhanced earnings momentum.