Spanish companies Enagas (ES:ENG) and Mapfre (ES:MAP) are currently offering higher dividend yields to investors. These are also among the top 10 high-dividend-paying companies in Spain.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Here, we have used TipRanks’ Best Spain Dividend Stocks to pick these companies. With the help of this tool, users choose from the top dividend-paying companies in any particular market and compare them on many key factors, like analyst recommendations, price targets, dividend yield, and more.

Let’s have a look at some details.

Enagás S.A.

Enagas is a Spanish utility company that owns the country’s national gas grid. The company is involved in the business activities of natural gas transmission and maintaining the infrastructure.

The company has a deep history of stable dividends, with a growth rate of 4.4% p.a. over the last ten years. In its 2022 annual report, the company announced an interim dividend of €0.68 per share. The company’s total dividend for the year is €1.72 per share. According to the company’s future projections, the dividend could reach €1.74 per share in 2023.

Even though analysts feel the dividends are not expected to grow more, the current dividend yield of 7.82% still makes an attractive case for income-seeking investors.

Enagas Share Price Forecast

The company’s stock started this year on a positive note with a gain of 11.25% YTD.

According to TipRanks, ENG stock has a Moderate Sell rating based on four Sell, one Hold, and one Buy recommendations.

The average price target is €15.53, which is 12.51% lower than the current price level.

Mapfre, SA

Based in Spain, Mapfre is a leading insurance company. It offers life, health, property, accident, and casualty insurance services in around 80 countries worldwide.

In February, the company reported a 16% fall in its profits for 2022, due to a rise in natural disasters and rising inflation costs. This was despite posting a 1.8% increase in its revenues of €29.51 billion as compared to 2021.

Coming to dividends, the company has a dividend yield of 6.37%. For 2022, the company announced a final gross dividend of €0.085 per share, which is payable in May 2023. This brought the total dividends to €0.145 per share for the year, which is similar to the dividends at pre-pandemic levels. Moreover, the company was able to increase its payout to 69.5% in 2022, up from its target of 50%.

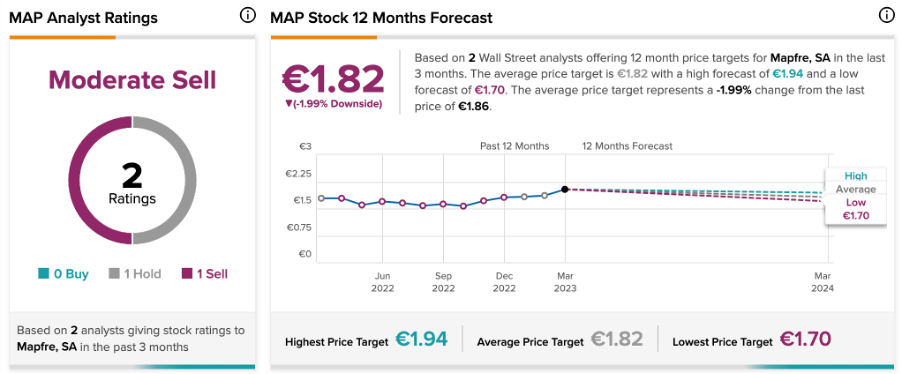

Mapfre Stock Forecast

MAP stock has a Moderate Sell rating based on one Hold and one Sell recommendation. It has an average price target of €1.82, which is almost 2% lower than the current level.

Conclusion

According to analysts, the share prices of ENG and MAP have no upside potential. However, investors looking for some extra passive income could consider these for their portfolios.