Spanish companies Enagás (ES:ENG) and Acerinox (ES:ACX) are presently offering dividend yields exceeding 6%. Additionally, they rank among the top 10 companies in Spain with the highest dividend payouts.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

When it comes to potential capital growth, Enagás does not provide significant opportunities for investors, and analysts have rated the stock as a Moderate Sell. On the other hand, Acerinox has received a Strong Buy rating, indicating a growth potential of over 30%.

Here, we have used TipRanks Top Spain Dividend Stocks to select these companies. This tool enables users to select from the leading dividend-paying companies in a specific market and compare them based on various crucial factors, such as analyst recommendations, price targets, dividend yield, and other relevant metrics.

Let’s take a look at some details.

Enagás S.A.

Enagás is a Spanish utility company that possesses the national gas grid of the country. The company is engaged in the operations of natural gas transmission and infrastructure maintenance.

The company boasts a dividend yield of 7.75%, which is significantly higher than the industry average of merely 3%. The company’s annual dividend per share in 2022 was €1.72, and based on the company’s forecasts, it is expected to potentially increase to €1.74 per share in 2023. The company will pay its interim dividend of €0.87 per share in July 2023.

Moving forward, the management has made a firm commitment to maintain the dividend at €1.74 per share until 2026, which makes it an attractive option for income investors.

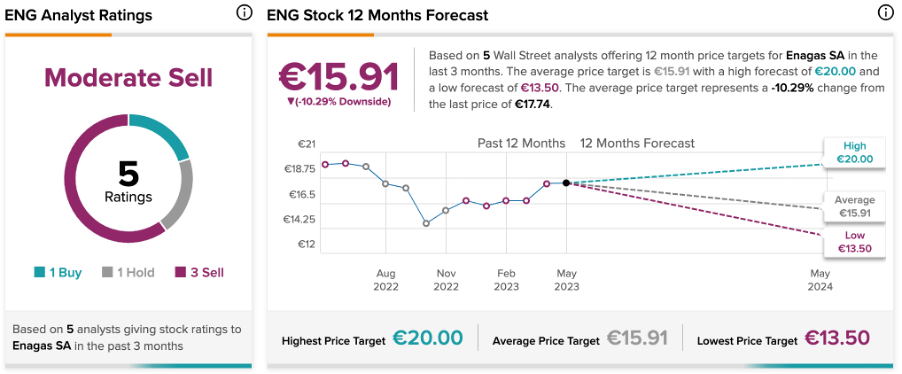

Enagás Share Price Forecast

According to TipRanks, ENG stock has a Moderate Sell rating based on three Sell, one Hold, and one Buy recommendations.

The average price target is €15.91, which is 10.3% lower than the current price level.

Acerinox, S.A.

Acerinox is among the leading manufacturers of stainless steel in the world. Approximately half of the company’s revenues are generated in the North American region.

For the year 2022, the company announced a yearly dividend of €0.60 per share, representing a notable 20% increase compared to the previous year. For 2023, the company has paid a dividend of €0.24 per share so far in January. The company’s dividend yield of 6.48% versus the industry average of 1.87% is quite impressive.

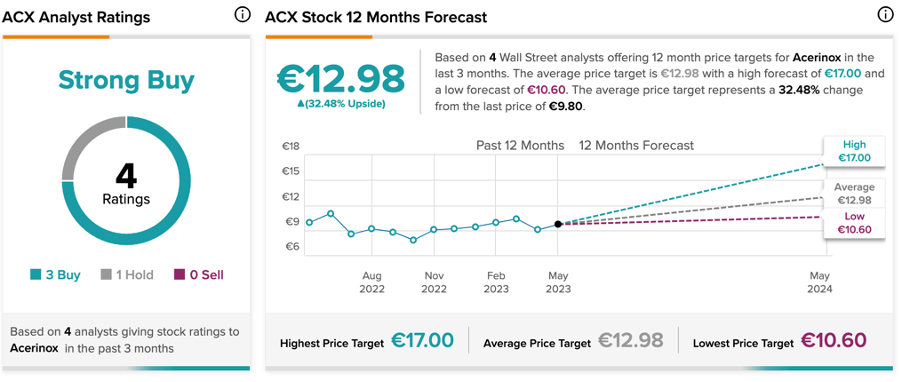

Acerinox Share Price Forecast

According to TipRanks, ACX stock has a Strong Buy rating based on three Buy and one Hold recommendations.

At an average price forecast of €12.98, analysts are predicting a growth of 32.5% on the current share price.

Conclusion

Investors seeking additional passive income could potentially consider adding these to their portfolios. Among these stocks, analysts have given a Strong Buy rating to ACX, indicating positive growth potential. On the other hand, ENG has been rated a Moderate Sell, suggesting a potential decline in the share price.