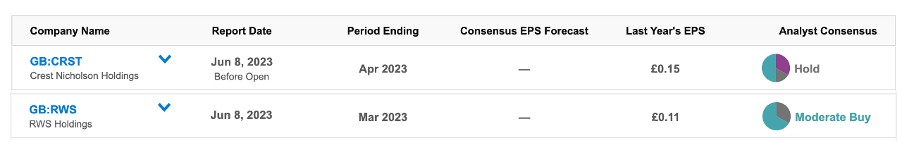

UK-based Crest Nicholson (GB:CRST) and RWS Holdings (GB:RWS) reported their Q2 2023 earnings yesterday. Analysts hold a bullish outlook on RWS stock, forecasting a potential share price growth of approximately 78%. On the other hand, Crest Nicholson has received a Hold rating from analysts, indicating a growth potential of 12%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The TipRanks Earnings Calendar serves as a valuable tool for identifying companies that have recently disclosed their earnings as well as those with upcoming announcements. Investors can utilize this resource to conduct additional research on these stocks, thereby augmenting their decision-making process.

Let’s explore this further.

Crest Nicholson Holdings PLC

Crest Nicholson is a real estate company focused on residential construction, including houses, apartments, and townhouses.

The company announced its half-yearly earnings for 2023 on June 8. Amid the difficult environment for the housing market, the company posted lower revenues and profits. The revenues were down from £364.3 million to £282.7 million, mainly driven by an 18% decline in home completions. The pre-tax profits also decreased to £20.9 million, as compared to £52.5 million last year.

The company is expecting a better second half and anticipates its pre-tax profits for the full year to be in line with analysts’ estimates of £73.7 million.

Yesterday, analyst Glynis Johnson from Jefferies confirmed her Buy rating on the stock, suggesting a growth of 45% in the share price.

Crest Nicholson Share Price Target

According to TipRanks’ analyst consensus, CRST stock has a Hold rating. The stock has three Buy, one Hold, and two Sell recommendations.

The average share price forecast is 258.17p, which is almost 12% higher than the current price level.

RWS Holdings PLC

RWS Holdings is a UK-based services company that provides intellectual property support services along with translation services.

RWS published its half-year earnings report for 2023, which ended on March 31. The company posted a 2.5% growth in revenues of £366.3 million, up from £357.3 million in the corresponding period a year ago. However, pre-tax profits were down by 10% to £54.4 million. Moving forward, the company is optimistic regarding its full-year outlook with its new customer wins, solid balance sheet, and planned cost-cutting measures.

After the release of results, Berenberg Bank’s analyst Calum Battersby reiterated his Buy rating on the stock yesterday. His price target of 470p implies a huge upside of 106.7% in the share price.

Is RWS Holdings a Buy?

RWS stock has a Moderate Buy rating on TipRanks, based on two Buy and one Hold recommendations.

The average target price is 405p, which implies an upside of 78% on the current trading price.

Conclusion

Amid the tough operating market conditions, Crest Nicholson posted lower numbers in its half-yearly results. However, analysts anticipate an improvement in the second half and recommend holding on to the stock.

For RWS, analysts are highly bullish on the prospects and predict a growth rate of more than 75% in the share price.