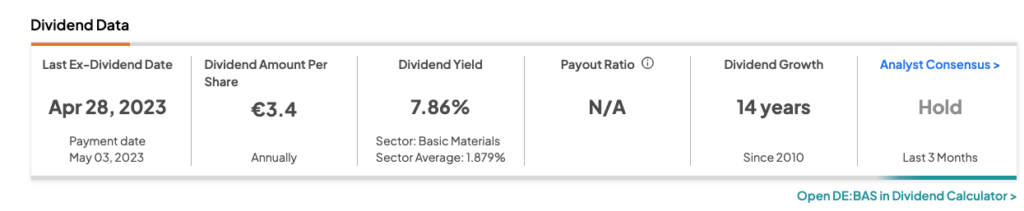

The DAX40-listed BASF SE (DE:BAS) is a popular German dividend stock that offers investors a stable income option. The company carries a compelling dividend yield of 7.86%, surpassing the sector average of 1.9%. Additionally, BASF holds a position in the DivDAX share index, which includes the top 15 companies with the highest dividend yields among the DAX 40 constituents.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

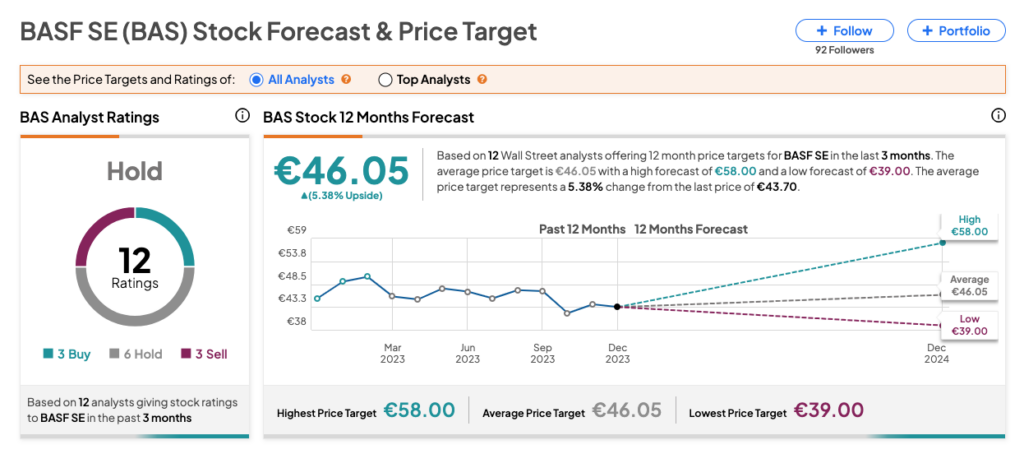

The company’s stock has displayed volatility, yielding a return of just 2.51% year-to-date. Analysts predict potential short-term disruptions for the company, attributing them to the ongoing economic slowdown and margin pressures. As a result, they have assigned a Hold rating to the stock, with a modest upside of 5.4%.

Based in Germany, BASF is a prominent chemical manufacturing company in Europe. It produces, markets, and sells a diverse range of products, including chemicals, plastics, crop protection, and performance products.

In this article, we’ve used TipRanks’ Best German Dividend Stocks tool to fine-tune our selection of this stock, taking into account a range of additional considerations.

BASF SE Dividend History

Over the last few years, BASF has consistently demonstrated a track record of sustaining and even improving its dividend payouts. In May 2023, the company distributed a dividend of €3.4 per share for the fiscal year 2022, maintaining a dividend level compared to the previous year. Notably, BASF’s dividends have exhibited steady growth, progressing from €2.60 in 2012 to €3.40 in 2022.

What is the Forecast for BASF Shares?

According to TipRanks’ analyst consensus, BAS stock has a Hold rating based on a total of 12 recommendations. This includes six Hold, three Buy, and three Sell ratings. The BASF share price target is €46.05, which shows a growth of 5.4% from the current price level.