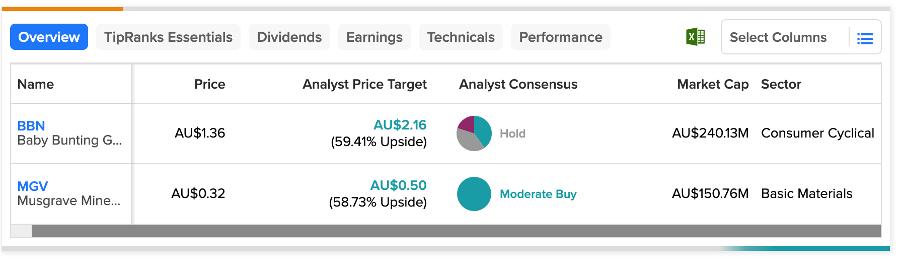

ASX-listed companies Baby Bunting Group Ltd. (AU:BBN) and Musgrave Minerals Limited (AU:MGV) offer an attractive opportunity to investors with more than 50% upside potential in their share prices. As per analysts’ evaluations, Baby Bunting is assigned a Hold rating, whereas Musgrave has been given Moderate Buy rating.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let’s take a look at these companies.

Baby Bunting Group Limited

Baby Bunting is a leading retail company in Australia, offering an unparalleled assortment of top-notch brands in prams, car seats, furniture, toys, and more.

The company’s stock plunged to its lowest point in five years yesterday and lost around 20% after it released its trading update with disappointing numbers. Despite its promotional activities, the company posted lower sales, causing a sense of worry among investors.

On a comparable store basis, the company’s sales have witnessed a 3% decline YTD. The management has issued a cautionary statement, projecting the company’s sales to be in the range of AU$509 million and AU$513 million, with comparable store sales experiencing a decline of 4% to 5% compared to the previous year.

As a result, it is also anticipated that this will result in a pro forma net profit after tax of between $13.5 million and $15 million for FY 2023, down by 49% to 54% on a year-over-year basis.

Baby Bunting Share Price Forecast

After the announcement of its trading update, James Bales from Morgan Stanley reiterated his Buy rating on the stock today, forecasting an upside of 158%.

Likewise, analysts at Ord Minnett and Morgans have reiterated their Hold ratings on the stock, suggesting respective growth rates of 18% and 40%. On the contrary, Sam Teeger from Citigroup has downgraded the stock to Sell and anticipates a downside of 18.8% in the share price.

Overall, BBN stock has a Hold rating on TipRanks based on two Buy, two Hold, and one Sell recommendations. At an average price of AU$2.16, analysts are predicting an upside of almost 60% in the share price.

Musgrave Minerals Limited

Musgrave Minerals is a mineral exploration company in Australia with a primary focus on silver, gold, copper, and nickel resources.

Yesterday, the company’s stock went up by 17% after it received a takeover offer from Westgold Resources (AU:WGX). The consolidation will bring together the regional assets of both groups, resulting in the creation of a larger-scale, more profitable, and highly attractive gold mining entity for investors. The acquisition will also expedite and reduce the uncertainties associated with the development of Musgrave’s Cue Gold Project.

Musgrave has yet to review the offer and make an official statement. However, the shareholders were happy with the news, pushing the share price higher.

Is Musgrave Minerals a Buy?

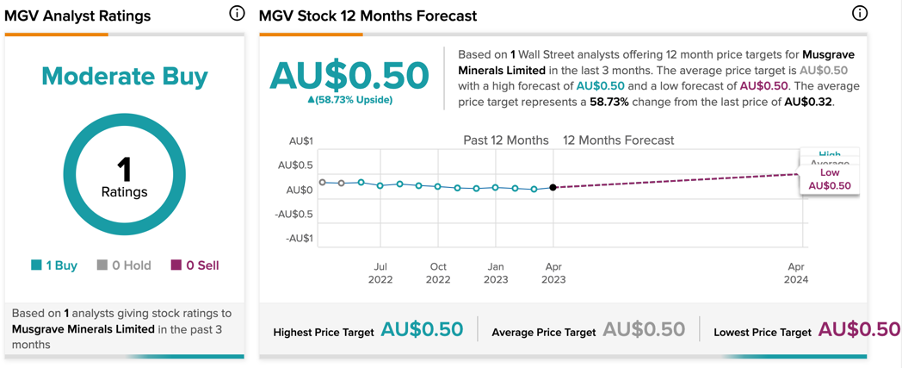

MGV stock has a Moderate Buy rating on TipRanks based on one Buy recommendation from analyst Paul Howard from Canaccord Genuity.

Two days ago, he reiterated his Buy rating on the stock with a price target of AU$0.50, implying an upside of 58.7% in the share price.

Conclusion

The recent advancements in these two ASX-listed companies have captured the interest of investors, resulting in significant shifts in their respective share prices. Looking ahead, analysts maintain an optimistic outlook for both stocks, projecting a growth potential of over 50% in their share prices.