In major news on Australian stocks, Sonic Healthcare Limited (AU:SHL) announced its acquisition of Dr. Risch Group to boost its footprint in the Swiss market. Sonic Healthcare shares gained momentum in early trading hours but ended the day at a loss of 0.22% on Wednesday. Year-to-date, SHL stock is trading down by more than 15%.

Sonic Healthcare provides laboratory, pathology, radiology, and primary care medical services in Australasia, Europe, and North America.

Understanding the Deal’s Rationale

With a history spanning over 50 years, Dr. Risch Group is a leading medical laboratory company with 16 centres in Switzerland and Liechtenstein. In 2023, Dr. Risch’s Swiss laboratories yielded revenue of CHF94 million, while the laboratory in Liechtenstein contributed an additional CHF8 million. Through this acquisition, Sonic will integrate its existing business in Switzerland with Dr. Risch’s operations, presenting a significant growth opportunity for the company.

The deal, scheduled to close by the end of this month, is expected to boost EPS (earnings per share) from 2025. Further, once the synergies are achieved, the return on invested capital (ROIC) is projected to surpass Sonic’s cost of capital. Additionally, the company anticipates that several synergies will be realized from the deal, particularly in infrastructure and operational areas.

The purchase price of CHF117 million includes shares of Sonic valued at CHF30 million, while the remaining balance will be financed through the company’s existing cash and debt facilities.

Interstingly, Sonic acquired a Swiss laboratory network from SYNLAB Group in June 2023, to expand its presence in the region. These deals further strengthen the company’s expansion efforts in Europe.

Is Sonic Healthcare a Good Buy?

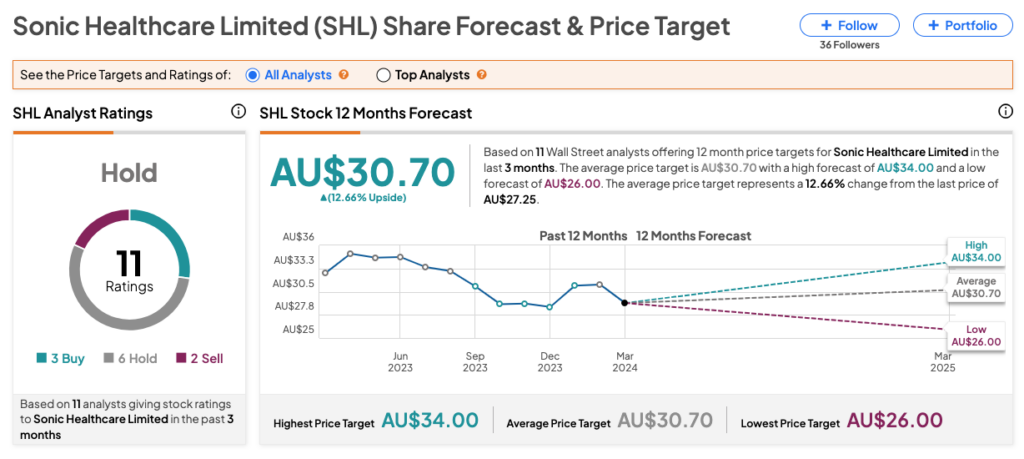

According to TipRanks’ consensus forecast, SHL stock has a Hold rating based on three Buy, six Hold, and two Sell recommendations. The Sonic Healthcare share price target is AU$30.70, which is 12.6% above the current trading level.