Shares of U.K.’s luxury car maker Aston Martin Lagonda Global Holdings plc (GB:AML) are trending higher this morning on news that executive chairman Lawrence Stroll is strategizing with bankers to manage a nearly $1.4 billion debt burden that is soon to mature. The company must generate generous operating profits or raise additional funds to deleverage its balance sheet. AML shares were up 3.8% at the time of writing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Aston Martin manufactures high-end sports cars with a legacy spanning over 100 years. The company is known for its design and automotive excellence and includes models like Vantage, DB11, DBS, DBX, and Valkyrie. AML shares have lost over 4% in the past year.

More About Aston Martin’s Looming Debt

As per a Bloomberg report, roughly $1.1 billion of bonds are due in November 2025. The bonds carry a coupon of 10.5%, meaning AML must shell out around $120 million per year toward interest payments. Alongside the bond, AML has a revolving credit facility of $99.8 million due next year and a $121 million note due in 2026.

Stroll addressed the issues, stating that the company is finding the most suitable way to raise liquidity that will be in the best interest of the company and shareholders. One of the ways could be to raise money from existing large shareholders. However, the macroeconomic landscape is unfavourable currently as the anticipated interest rate cuts remain in doubt.

Aston Martin boasts some of the industry heavyweights as its major shareholders. These include Saudi Arabia’s Public Investment Fund (PIC), China’s Zhejiang Geely Holding Group Co Ltd (HK:0175), and electric vehicle maker Lucid Group (NASDAQ:LCID).

AML is scheduled to report its full-year Fiscal 2023 results on February 28. In the third quarter update, Aston Martin warned of logistics challenges and cut the forecast for its full-year vehicle deliveries. Notably, AML affirmed its full-year guidance but reduced the volume outlook due to initial delays in the much-awaited DB12 sports car ramp-up during Q3. Investors will keep a keen eye on the details, if any, about the company’s debt management progress during the Fiscal 2023 earnings call.

Is Aston Martin a Buy or Sell?

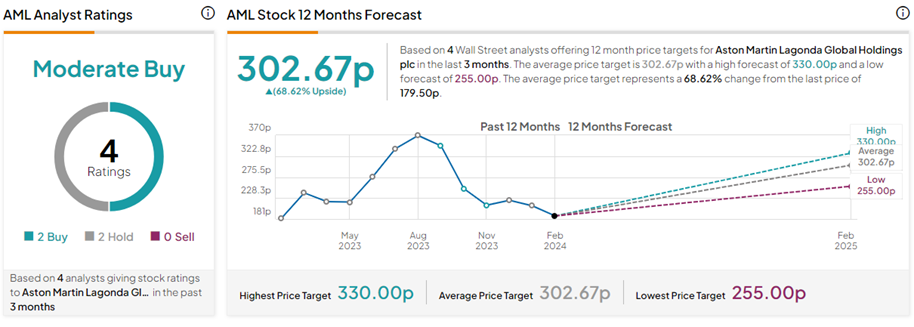

Yesterday, Goldman Sachs analyst George Galliers reiterated a Buy rating on AML stock. Overall, with two Buys versus two Holds, AML stock has a Moderate Buy consensus rating on TipRanks. The Aston Martin Lagonda Global Holdings share price forecast of 302.67p implies 68.6% upside potential from current levels.