The owner of British restaurant chain Wagamama, The Restaurant Group (GB:RTN), has agreed to go private in a deal with private equity firm Apollo Global Management LLC (NYSE:APO) for £506 million. The deal came through after the group struggled to recover post-pandemic and has been facing the wrath of activist investors, including Irenic Capital and Oasis Management.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company, which turned down the previous three offers from Apollo, now urges the shareholders to approve the deal. According to this deal, TRG shareholders will receive 65p per share from Apollo, which is 34% higher compared to the stock’s latest closing price.

Over the last few years, TRG has suffered four consecutive annual losses and has struggled to revive its sales. As a result, the company’s Chairman, Ken Hanna, announced his departure from the company due to mounting pressure from investors, calling for changes in management. In September, the company also sold its loss-making brands, Frankie & Benny and Chiquito, to the Big Table Group to enhance its margins.

The Restaurant Group is one of the largest hospitality businesses in the UK, overseeing around 400 restaurants and pubs across the country.

Analyst Reaction

Analysts feel the offer price doesn’t do justice to TRG’s quality of assets and is low. Today, Liberum Capital downgraded its rating from Buy to Hold on the stock, forecasting a 2% downside in the share price. Liberum stated that even though the bid price is low, the market expects the deal to be successful. This anticipation is based on “cash structure, activist shareholder support, helped by recent market turmoil.”

Is The Restaurant Group a Buy?

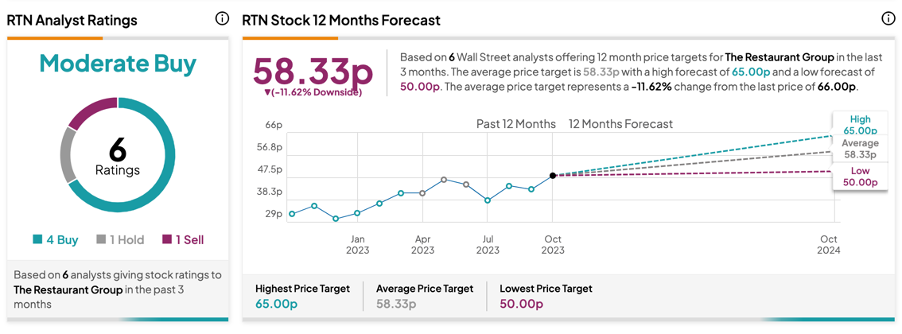

According to TipRanks’ analyst consensus, RTN stock has a Moderate Buy rating. The stock has a total of six recommendations from analysts, of which four are Buy. The TRG share price forecast is 58.33p, which is 11.6% lower than the current price level.