The leading sportswear giant Adidas AG’s (DE:ADS) stock has experienced 50% growth in 2023, taking the top spot on the DAX index. The stock has recovered well after hitting a low point in February, triggered by its split from Kanye West. The rise in Adidas share price was also supported by a huge demand for its brands, Simba, Gazelle, Spezial, and Campus, contributing to growth for Adidas Originals. Despite the prospects, analysts have a neutral stance on the stock and see limited upside potential. Overall, the stock has received a Hold rating from analysts on TipRanks.

Recent Ratings

Today, analyst Richard Edwards from Goldman Sachs confirmed his Hold rating on the stock, with a forecast of 12% upside.

Prior to that, Bernstein analyst Aneesha Sherman upgraded her rating on the stock from Hold to Buy this week, predicting a growth of 7.7%.

Sherman is bullish on the Adidas Terrace shoe range and believes it will be a €1 billion business for the company, driving 3-4% growth in 2024. The company is actively expanding production, aiming to reach over 10 million pairs next year. However, there is also a sense of caution regarding over-distribution.

Improving Outlook

Last month, the company reported its Q3 earnings report with better-than-expected numbers. Revenue increased by 1% on a currency-neutral basis, driven by growth in all regions except North America. Sales in North America declined by 9% due to existing higher inventory levels. Among its categories, footwear sales grew by 6%, while apparel sales declined by 6% in the third quarter.

The company is anticipating only a low-single-digit decline in its revenues compared to the initial projection of a high-single-digit decline. Additionally, it expects a modest operating loss of €100 million, in contrast to the initial projection of an operating loss of €700 million.

Moreover, the company is noticing growing interest in its brand and products across all markets for its Fall/Winter 2024 range.

Is Adidas a Good Share to Buy?

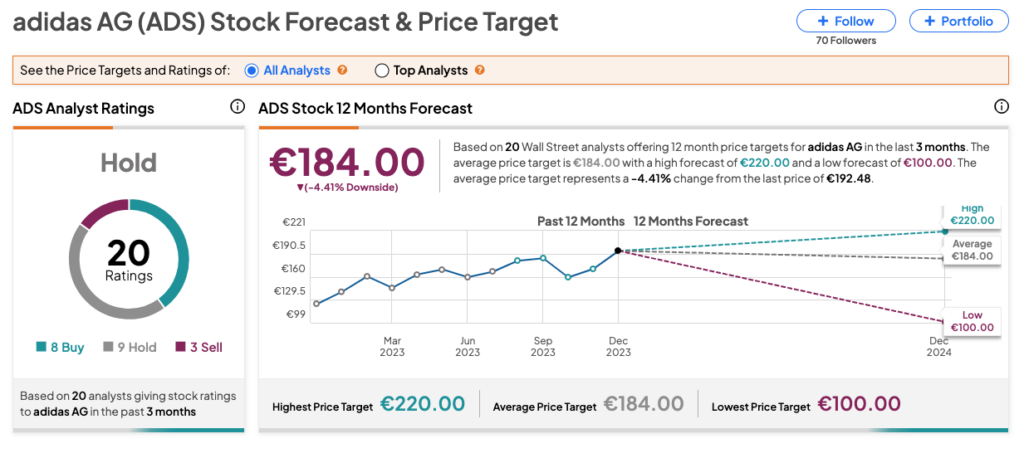

On TipRanks, ADS stock has a Hold Buy rating backed by a total of 20 recommendations. It includes eight Buy, nine Hold, and three Sell ratings. The Adidas share price prediction is €184.0, which is 4.4% lower than the current level.