Australia is the land of mining companies due to its top-class mineral and metal deposits. The top four commodities exported by the nation are iron ore, coal, copper, and gold. Also, Australia has good trade relations with China, which helps expedite the whole process.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

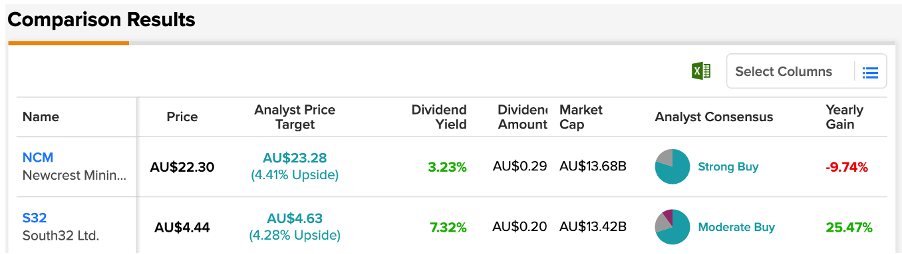

TipRanks’ Stock Comparison tool provides a perfect way for investors to pick a stock from any particular sector of a region. Here we have picked two of the top 10 leading mining companies in Australia, Newcrest Mining Limited (AU:NCM) and South32 Ltd. (AU:S32).

Let’s take a look at these stocks in detail.

Newcrest Mining Limited – Higher Gold Prices and Improved Production

Based in Australia, Newcrest Mining is among the world’s largest gold mining companies. The company has mines in Australia, Canada, and Papua New Guinea.

The company’s stock has been volatile for quite some time now and has been trading down by 5.3%. But analysts are positive that gold stocks will now recover due to their position as a hedge against soaring inflation. Analysts also feel that the gold market has already hit bottom in 2022 and that the gold price will rise in 2023.

The company posted lower production numbers in its full-year results for 2022. In comparison to 2021, the group’s gold production fell by 7%, and its copper production fell by 15%. This was mainly due to maintenance activities, planned replacements, and unplanned downtime at sites like Lihir and Cadia, which resulted in lower production volumes. This pushed the revenues down by 8% to $4.2 billion. The underlying profits were also down by 25% to $872 million.

Moving forward in 2023, analysts believe the company will overcome the production challenges, which will boost its top line. The company has posted guidance for gold production to be between 2,100 and 2,400 thousand ounces in 2023. In 2022, this figure was 1,956 thousand ounces.

Talking about the valuation, Newcrest is well-placed with a P/E ratio of 15.5, as compared to its competitors, Evolution Mining Limited (AU:EVN) at a P/E ratio of 18.4 and Northern Star Resources Ltd. (AU:NST) at 31.8. The company’s dividend yield of 3.23% is above the sector average of 1.87%.

Is Newcrest a Good Investment?

According to TipRanks’ rating consensus, Newcrest’s stock has a Strong Buy rating.

The average share price forecast is AU$23.35, which shows a change of 4.7% from the current price level.

South32 Limited – Diversified Portfolio and Solid Dividends

South32 is a mining and metals company from Australia that produces commodities like bauxite, alumina, copper, aluminum, silver, lead, zinc, nickel, and more. The company has operations in Australia, Southern Africa, and South America.

South32 has the advantage of a highly diversified portfolio, which reduces its exposure to any single metal. Also, the company has successfully transformed its portfolio towards new-age metals like nickel, manganese, etc. These metals are currently witnessing huge demand, which will push the top line of the company.

In 2022, the company achieved record production numbers in Worsley alumina, at 3,991 kilotonnes at a sale price of $409 per tonne. This is much higher than the sale price of $293 per tonne in 2021. The company also posted a 22% increase in nickel production to 41.7 kilotonnes. This helped the company post a 69% growth in total revenues of $9.3 billion.

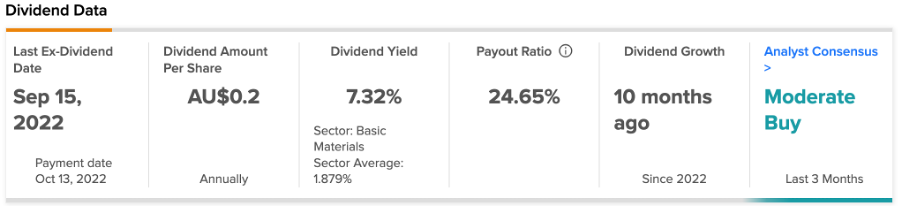

Another highlight for the company is its dividend policy. At a dividend yield of 7.32% against the sector average of 1.87%, the stock is a gem for value investors. In 2022, the company declared a dividend of $0.227 per share, which was 363% higher than 2021’s dividends.

In the fiscal year 2022, the company paid a record $1.3 billion to its shareholders in dividends, special dividends, and share buybacks.

South32 Share Price Forecast

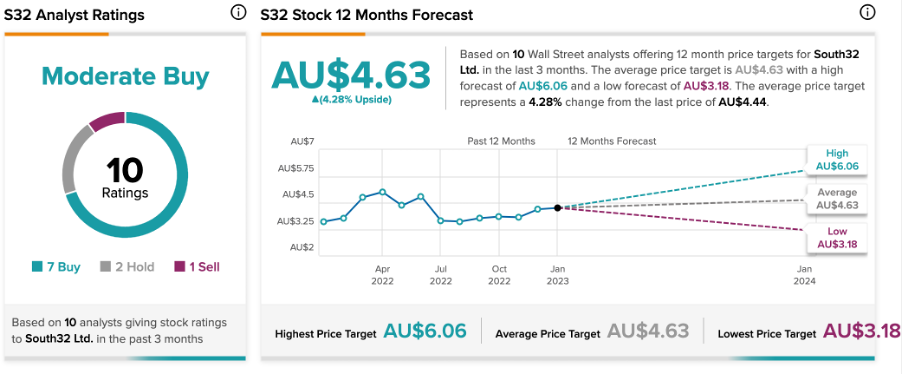

On TipRanks, South32 stock has a Moderate Buy rating, based on seven Buy, two Hold, and one sell recommendations.

It has an average target price of AU$4.63, which shows a slight change of 4.3% from the current price level. The stock has gained a huge 82% in the last three years.

Conclusion

The experts are highly bullish on the Australian mining sector. These two stocks with strong earnings growth and dividend payments could be a great support to investors’ portfolios in 2023.