Global-e Online (GLBE) shares jumped almost 25% on August 16 after the company registered impressive second-quarter revenue growth and raised its guidance for FY2022, beating analysts’ expectations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in Israel, Global-e Online Ltd. provides e-commerce solutions that enable and accelerate global, direct-to-consumer cross-border E-Commerce.

A Snapshot of Q2 Results

During the quarter, revenues of Global-e Online totaled $87.3 million, up 52.4% year-over-year. It easily surpassed the average prediction of $83.5 million. In particular, Gross Merchandise Value (GMV) grew 64% to $534 million.

Despite strong revenue figures, the company posted a loss of $0.31 per share that fell one cent short of analysts’ expectations of $0.30 per share. The company had reported a loss of $0.25 per share in the same quarter last year.

Adjusted gross margin grew an impressive 580 bps year-over-year to 41.8% versus 36.0% in the year-ago quarter.

However, at the end of the second quarter, the company reported cash and cash equivalents of $268 million, lower than $394.4 million at the end of the prior-year period.

The CEO of Global-e Online, Amir Schlachet, said that the results “illustrate the continued momentum of our business, as evident from top-line growth, improved profitability and the strong new bookings pipeline.”

Global-e Online Updates FY2022 Outlook

Based on robust second-quarter results, management has updated its financial guidance for FY2022.

The company now forecasts FY2022 revenues to be in the range of $406-$426 million, higher than the consensus estimate of $390.4 million. Adjusted EBITDA is expected to be in the range of $41-$46 million.

For the third quarter, revenues are projected to be in the range of $99.5-$102.5 million versus the consensus estimate of $93.81 million. Adjusted EBITDA is expected to be in the range of $8.5-$11.5 million.

Is GLBE Stock a Good Buy?

According to TipRanks, Global-e Online commands a Strong Buy consensus rating based on eight unanimous Buys. GLBE’s average price forecast of $34.88 implies 2.59% upside potential.

Following the company’s second quarter results, Brian Peterson of Raymond James increased his price target on Global-e Online to $40 (17.65% upside potential) from $25 and reiterated a Buy rating.

Final Thoughts

GLBE is one of the stocks that has made a speedy recovery on Wall Street. Shares of Global-e Online are already up 50%, after losing half of their market capitalization over the past year.

Management looks confident “to tap the massive global direct-to-consumer opportunity,” as evident from its most recent major partnership with Disney (DIS) to support its direct-to-consumer efforts globally.

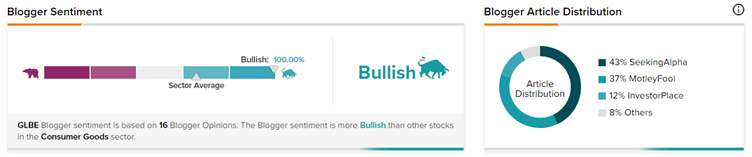

Further, TipRanks data shows that financial bloggers are 100% Bullish on GLBE stock, compared to the sector average of 66%.

Read full Disclosure