Nvidia aside, no Mag 7 stock has performed as strongly as Meta Platforms (NASDAQ:META) has this year, with shares up 64% in 2024. As the social media giant gears up to release its Q3 results Wednesday after the close, can the stock maintain its momentum?

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

No reason why not, appears to be the answer of Jefferies analyst Brent Thill, whose checks “continue to be bullish,” thus setting the scene for a strong readout.

Assessing the quarter’s performance, Thill says the majority of experts he has spoken to were “generally positive,” citing strong momentum as clients consistently rely on Meta as their primary channel for solid ROAs (return on ad spend). One expert noted that, unlike other platforms where growth expectations have generally been adjusted lower, his projections for META have been revised upwards vs. three months ago. He now forecasts a 23% year-over-year increase in client spending in the quarter, 3 percentage points higher than his previous forecast and only slightly lower than the 27% growth seen in Q2.

As for Thill’s expectations, despite a 9-point tougher comp, he sees Meta dialing in revenues above ~$39.75 billion, the midpoint of the guided range and amounting to a ~16.4% year-over-year increase. He also anticipates the revenue guide for Q4 will be higher than the Street’s forecast of ~$46.3 billion (up ~15.5% y/y) at the high end. When compared with typical seasonality, Thill thinks consensus expectations of 15% sequential growth appear conservative.

“Overall,” Thill summed up, “we continue to be encouraged by META’s ability to sustain double-digit rev growth, given the combination of higher engagement from AI investments, increased advertiser efficiency and ramping of incremental monetization formats (e.g. WhatsApp & Llama).”

Conveying his confidence, Thill has a Buy rating on the shares, backed by a $675 price target, implying gains of ~14% are in the cards for the next year. (To watch Thill’s track record, click here)

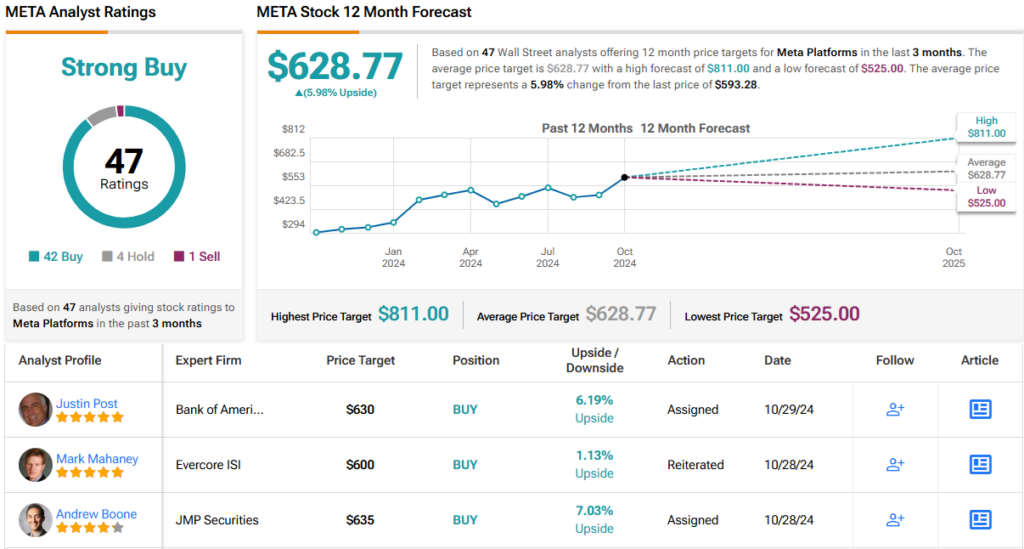

All in all, Meta remains a favorite among analysts, boasting a Strong Buy consensus rating based on 42 Buy recommendations, 4 Holds, and 1 Sell. Going by the $628.77 average price target, a year from now, investors will be pocketing returns of 6%. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.