General Motors (NYSE:GM) shares jumped nearly 8% in the early session today after the automotive major delivered an impressive set of fourth-quarter numbers. Revenue of $42.98 billion outpaced expectations by $4.17 billion. Further, EPS of $1.24 comfortably exceeded estimates by $0.08.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In Automotives, GMNA (GM North America) segment net sales remained largely unchanged at $35.23 billion. However, net sales in the GMI (GM International) segment declined to $3.94 billion from $4.32 billion in the year-ago period. On the other hand, GM’s net income margin improved by 30 basis points to 4.9% in Q4. The company’s total North American market share dropped to 15.2% from 16.2% in the prior year period. In sync, its market share in China dropped to 7.9% from 9.1% in the year-ago period.

For Fiscal Year 2024, the company anticipates adjusted EPS in the range of $8.50 to $9.50. Capital spending for the year is expected to hover between $10.5 billion and $11.5 billion. Yesterday, GM increased its quarterly dividend by 33% to $0.12 per share. The GM dividend is payable on March 14 to investors of record on March 1.

Is GM a Good Stock to Buy?

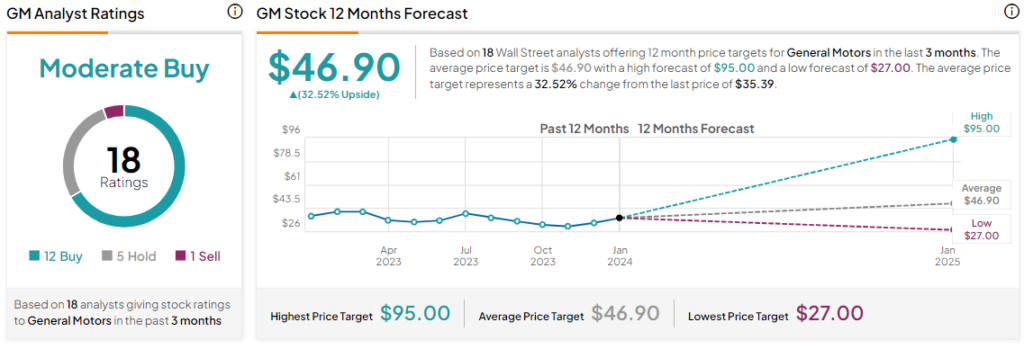

Overall, the Street has a Moderate Buy consensus rating on General Motors and the average GM price target of $46.90 implies a substantial 32.5% potential upside in the stock. That’s after a nearly 7.8% drop in the company’s share price over the past six months.

Read full Disclosure