General Electric (NYSE: GE) stock rose yesterday after one of its top officials hinted at an improving business in the second half of 2022. Also, the conglomerate’s healthcare arm announced its debut in the homecare market on the same day.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of this $82.7-billion company increased 1.2% to close at $73.28 on Thursday. Today, the stock is up another 2.6%.

In addition to the healthcare industry, General Electric has exposure to renewable energy, aviation, and power industries. Its headquarters is located in Boston, MA.

Second-Half 2022 Expectations

According to a report by Reuters, General Electric’s CFO, Carolina Dybeck Happe, communicated that the company is well-positioned to deal with supply-chain and inflation-related headwinds and sees its businesses improving in the second half of 2022.

The CFO’s comments came while addressing the Goldman Sachs Industrials and Materials Conference held on May 12.

Happe added that the company is working to ensure the availability of parts, better its productivity, and benefit from higher prices of its products. Of its prime businesses, solid improvement is expected in its healthcare and aviation businesses in the second half.

The company projects generating approximately 55% of its 2022 revenues in the second half, while operating profit share is pegged at 65% and net earnings share within the range of 75%-80%. The cash flow position is expected to be healthy for the full year.

GE Healthcare Business Expansion

GE Healthcare has stepped into the homecare market, expected to be worth $662.7 billion by 2027, with its decision to invest $50 million in Pulsenmore. The latter is an Israel-based company with expertise in providing homecare ultrasound solutions.

The association of the two companies equips GE Healthcare to promote Pulsenmore’s products and solutions globally and allows it to distribute its products in Europe and other nations. Further, GE Healthcare will back Pulsenmore for achieving FDA clearance in the U.S.

This homecare kit includes an ultrasound device (handheld), a mobile app for clinical consultations, and other features that make the task of doing an ultrasound hassle-free at home.

Roland Rott, the President and CEO of GE Healthcare Ultrasound, said, “We are excited about adding this highly complementary offering to our market-leading Women’s Health and Primary Care standard of care ultrasound diagnostics solutions, marking a strong step forward in enabling precision health.”

Wall Street’s Take

A few days ago, J.P. Morgan analyst Stephen Tusa reiterated a Hold rating on General Electric and a price target of $55 (26.7% downside potential).

Another analyst, Nicole DeBlase of Deutsche Bank maintained a Buy rating on GE while lowering the price target to $107 (42.7% upside potential) from $118.

Overall, the Street is cautiously optimistic about GE and has a Moderate Buy consensus rating based on nine Buys and four Holds. GE’s average price target at $104 suggests 38.7% upside potential from current levels.

Over the past year, shares of General Electric have decreased by 28.6%.

Blogger Sentiment

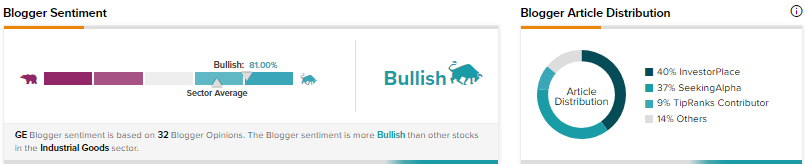

Per the TipRanks tool, the financial bloggers are 81% Bullish on GE compared with the sector average of 69%.

Conclusion

Improvements across businesses and investment decisions, like in Pulsenmore, will help enhance General Electric’s investment appeal.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Will Drive-Throughs at Starbucks Drive Up Returns?

Why Did ironSource Shares Plunge More Than 17%?

Is Visa Stock Attractive Now after Falling?