Geely Automobile Holdings Ltd. (HK:0175)-owned Volvo Cars has dropped its target of selling only electric vehicles (EVs) by 2030. This move comes as the demand for EVs has slowed down globally and the company needed to be more flexible in its approach. Volvo Cars was one of the first traditional automakers to commit to a full transition to EVs.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Geely, a Chinese conglomerate, is the largest shareholder in Sweden-based Volvo Cars.

Volvo Announces New EV Targets

Volvo now aims for 90% to 100% of its vehicles sold by 2030 to be fully electric or plug-in hybrid models, with up to 10% allowed to be mild hybrid models. This target replaces Volvo Cars’ previous goal of having its entire lineup fully electric by the end of the decade.

According to its Q2 results, fully electric vehicles comprised 26% of Volvo Cars’ lineup. The total share of electrified vehicles, including EVs and plug-in hybrids, was 48%.

Highlighting the hurdles to its electrification goals, Volvo Cars noted that the EV charging infrastructure has been implemented more slowly than expected. Additionally, some markets have reduced government incentives. Plus, recent tariffs on EVs in different countries have added to the uncertainty.

Jim Rowan, CEO of Volvo Cars, stated that it’s evident that the shift to electrification will not be smooth, with customers and markets adopting this transition at varying rates.

Volvo’s Decision Aligns with Mercedes

Volvo’s decision to cut back its EV target shows its alignment with other industry peers. German carmaker Mercedes-Benz Group (DE:MBG) had previously adjusted its EV target amid sluggish market conditions. Mercedes had earlier said that it plans to sell only electric cars by 2030. But now, it will do so only where market conditions permit.

Is Geely Stock a Good Buy?

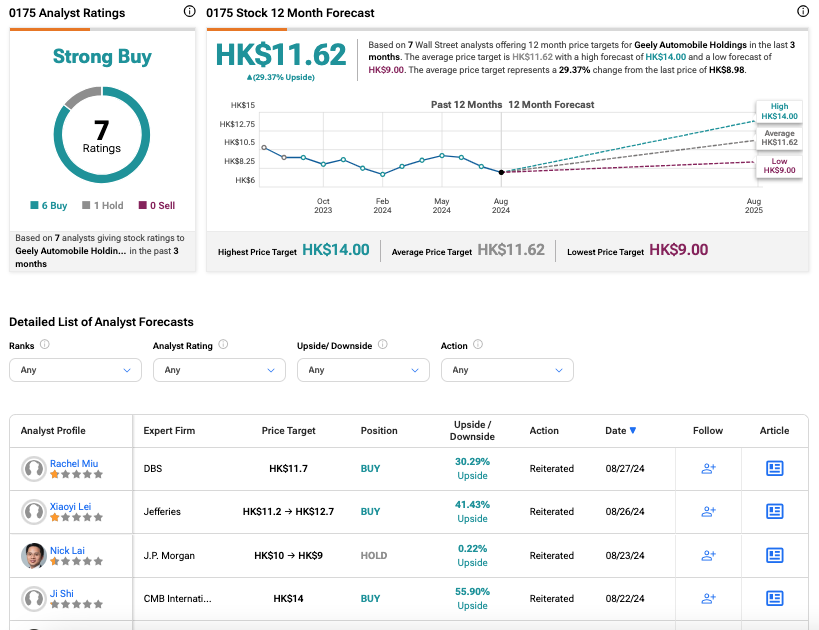

According to TipRanks, 0175 stock has received a Strong Buy rating, backed by six Buys and one Hold recommendation. The Geely share price target is HK$11.62, which implies an upside of 29.4% from the current trading level.