Shares of SWK Holdings (SWKH) have gained 55.3% over the past 12 months. The specialty finance company caters to small and mid-sized commercial-stage companies in the healthcare sector.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

SWK’s recent Q2 numbers surpassed the Street’s estimates on both top-line and bottom-line fronts. Against this backdrop, let us take a look at the financial performance of the company and understand what has changed in its key risk factors that investors should know.

Owing to strong performance in the Specialty Finance Receivables and Pharmaceutical Development segments, SWK’s Q2 revenue jumped 181.7% year-over-year to $22.3 million, beating consensus by $12.8 million.

The Chairman and CEO of SWK, Winston Black, said, “The second quarter continued a period of substantial value creation for SWK, highlighted by the 22.9% realized yield in our finance receivables segment, continued strong credit trends, and budding business momentum at Enteris.”

Earnings per share of $1.34 also beat analysts’ estimates by $1. (See SWK Holdings stock chart on TipRanks)

During the quarter, SWK’s subsidiary Enteris BioPharma completed the expansion of its manufacturing facility and launched a new CDMO business segment. Enteris also signed three new partner feasibility studies.

Moreover, SWK has formed a Strategic Review Committee to scout strategic alternatives in a bid to maximize shareholder value. The move comes after Carlson Capital, which owns 70% in SWK, withdrew its non-binding proposal to acquire SWK’s finance receivables portfolio.

Black expects the strong Q2 momentum to continue in 2022 as the company sources and secures more value-creating opportunities.

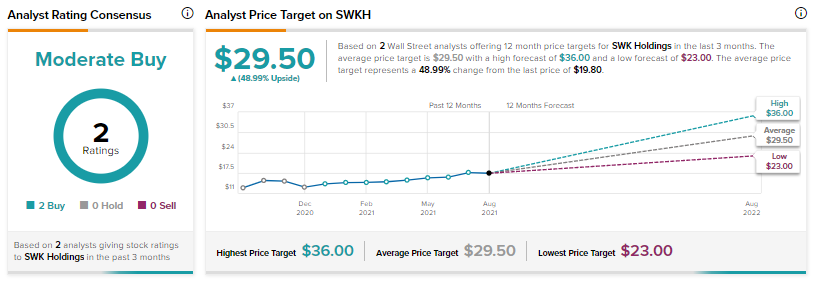

On August 18, Colliers Securities analyst Kyle Bauser reiterated a Buy rating on the stock with a price target of $36.

Maxim Group’s Michael Diana, another analyst covering the stock, also has a Buy rating on SWK with a price target of $23.

Diana said, “The strategic review could result in a sale of SWKH in whole or in part, or no sale at all (status quo). In our view, SWKH is undervalued, so that whatever course the strategic review committee chooses should be beneficial for shareholders.”

The two ratings add up to a Moderate Buy consensus. The average SWK Holdings price target of $29.50 implies 50% upside potential.

Now, let’s look at what has changed in the company’s key risk factors.

According to the new Tipranks’ Risk Factors tool, SWK’s main risk categories are Finance & Corporate and Legal & Regulatory, which account for 52% and 20%, respectively, of the total 46 risks identified. Since June, the company has added one key risk factor under the Finance & Corporate risk category.

SWK acknowledges that under the strategic review, its board of directors has not made any decision to enter into any transaction yet and there can be no assurance that the scouting of strategic alternatives will lead to any transaction. The company has not set a timeline for the process and does not plan to comment on it any further until a specific transaction is approved, or otherwise determined, to be appropriate.

The Finance & Corporate risk factor’s sector average is at 49%, compared to SWK’s 52%.

Related News:

Sleep Country Pilots Partnership with Walmart Canada

The Valens to Buy Cannabis Retailer Citizen Stash

Manulife Announces ‘Fuel Up Fridays’