Shares of GameStop (GME) have experienced turbulent performance throughout 2024, which surprised no one. With two major rallies followed by a sharp correction, the stock’s performance appears purely speculative, offering little stability for investors. Over the first two quarters of this year, the company has experienced a significant decline in revenue, leading to questions surrounding the company’s financial health. Several months ago, I wrote that the ride of the well-known meme stock was likely ending.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, a potential resurgence cannot be completely ruled out after the firm recently raised roughly $3.5 billion in new capital. The fresh cash stockpile is potential fuel for acquisitions and may provide some hope for the Diamond Hands crew (so you can refrain from harassing me on social media… again). The company’s future remains uncertain as management has yet to articulate a definitive strategy, so caveat emptor.

GameStop’s Business Declines While Its Fortune Rises

GameStop is a specialty retailer that offers a variety of games and entertainment products. These include new and pre-owned gaming consoles, accessories, including controllers and virtual reality products, and new and pre-owned gaming software. The company also provides digital content, from in-game digital currency to full-game downloads. In addition to gaming products, the company offers lifestyle merchandise for pop culture and technology enthusiasts.

The company once had over 6000 stores across the United States, Canada, Australia, and Europe. However, due to shifts in consumer behavior, that number has dwindled to under 3000 and continues to decline.

GameStop recently announced the successful completion of its at-the-market (ATM) equity offering program, selling all 20,000,000 registered shares and raising gross proceeds of approximately $400 million. This adds to the company’s cash balance of $4.2 billion, which it reported at the end of Q2. The company disclosed that the proceeds will be utilized for general corporate purposes, which may involve acquisitions and other investments.

Analysis of GameStop’s Recent Financial Results

The company recently reported performance for the second quarter. Net sales declined roughly 40% to $0.798 billion from $1.164 billion in the same period last year. However, the company turned around its net income, posting $14.8 million, compared to a net loss of $2.8 million in the second quarter of 2023. This helped to drive Q2 non-GAAP earnings per share (EPS) of $0.01, which beat expectations by $0.10.

As of quarter end, the company reported substantial cash, cash equivalents, and marketable securities totaling $4.204 billion.

Is GME Stock a Buy?

The stock has been on a volatile downward trend since the heady meme-stock craze days, shedding 75% since its peak in January 2021. It trades at the lower end of its 52-week price range of $9.95 – $64.83 and shows ongoing negative price momentum, trading below its 20-day (21.68) and 50-day (22.07) moving averages. Its current P/S ratio of 1.5x is north of the industry and its historical average, suggesting the stock trades at a premium.

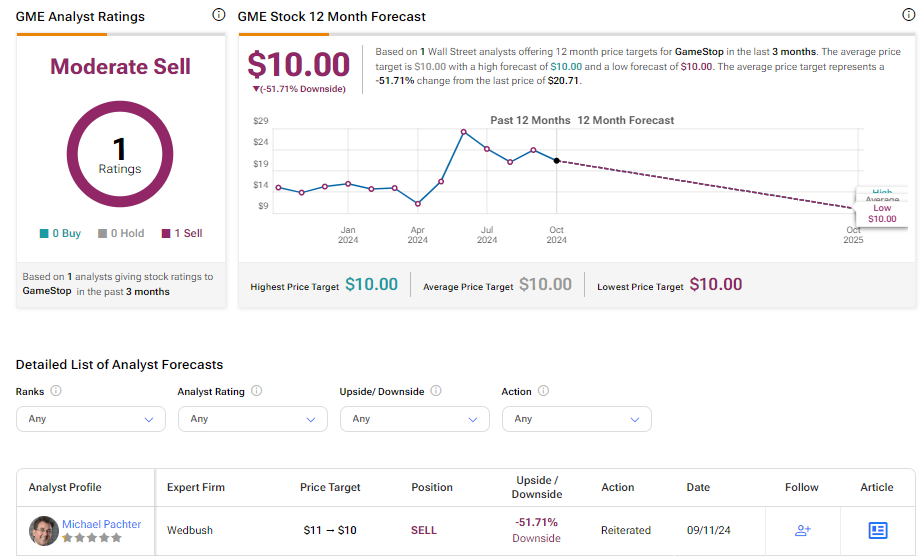

Wall Street follows the company thinly. However, Wedbush analyst Michael Pachter recently reiterated an Underperform rating while lowering the price target on the shares from $11 to $10. Given the company’s accelerated store closures, he noted that it would be reasonable for management to close all its stores and operate as a bank. Yet, management’s lack of commentary raises questions about the firm’s direction.

Based on the analyst recommendations, GameStop is rated a Moderate Sell. The price target for GME stock is $10.00, representing a potential decline of -51.71% from current levels.

Bottom Line on GME

GameStop’s stock volatility continues, with significant rallies and sharp corrections keeping everyone on their toes. While a recent capital injection plants the seeds for optimism, the lack of a clear strategic direction from the management is a cause for concern. As things stand, the company is showcasing an interesting dichotomy of dwindling business performance on the one hand and potential for acquisition-fueled resurgence on the other. Investors are advised to approach with caution.