Ahead of GameStop’s (GME) fiscal second-quarter earnings on September 10th, I’m sticking with my “Hold” stance on the stock, anticipating another challenging quarter – unless CEO Ryan Cohen has a surprise up his sleeve. Although expectations from the July quarter appear to be low, I believe taking a bearish stance on the stock remains risky. This caution is largely due to the potential impact of CEO Ryan Cohen’s strategy to leverage GME’s balance sheet, now bolstered by equity sales cash, to acquire other businesses.

In this article, I’ll explore GameStop’s current situation, what to expect from Q2 FY24 results, and why betting against the company still seems too risky.

GameStop Stock’s Recent Performance

GameStop’s performance this year continues to highlight that its stock trades more like a meme stock than based on fundamentals, making it difficult for me to take a stance other than neutral. To illustrate, the stock has reached a 52-week high of $64.83 and a 52-week low of $9.95 within this year alone.

Taking a broader view, some unconventional events have shaped GameStop’s year, driving the stock to a 21.5% year-to-date gain and outperforming the S&P 500 (SPY). This performance comes despite the company missing earnings estimates in the past couple of quarters.

This rise was fueled by an almost 400% surge from the stock’s yearly low in April to a peak in mid-May, driven by another meme rally. This time, the rally was sparked by the return of Roaring Kitty, a mysterious trader and YouTuber who played a key role in the 2021 GameStop short squeeze. Roaring Kitty disclosed a multimillion-dollar bet on GameStop shares once again, reigniting euphoria and FOMO among retail investors and traders across social media platforms.

The Meme Mania Boosts GameStop’s Cash Reserves

The renewed hype around GameStop provided an ideal opportunity for management to strengthen the company’s balance sheet. With GameStop’s business in a precarious position, characterized by declining sales and struggles to achieve breakeven profitability, the company took advantage by selling a significant amount of equity.

In May, GameStop sold 45 million shares, raising $933 million in cash. Following another rally a few weeks later, it sold an additional 75 million shares in June, raising $2.10 billion. With these new funds, combined with the company’s previous cash reserves, GameStop now has about $4 billion on its balance sheet (to be reflected in the company’s next quarterly filings) and virtually no debt.

However, it’s important to note that equity sales typically have a significant side effect on a company’s share price. By increasing its float by around 120 million new shares, GameStop significantly diluted its existing shareholders. As a result, after briefly peaking again in mid-July, GameStop shares have since fallen by around 25%.

GameStop’s Q2 Expectations: A Tough Quarter Ahead

A large part of my neutral outlook on GameStop ahead of earnings stems from my belief that no news about the company’s financial performance in Q2 FY24 is likely to significantly impact its share price.

To start, although 2023 was the first year since 2018 that GameStop reported an annual profit, expectations for 2024 suggest this achievement won’t be repeated. Projections indicate a $0.10 loss per share for the year.

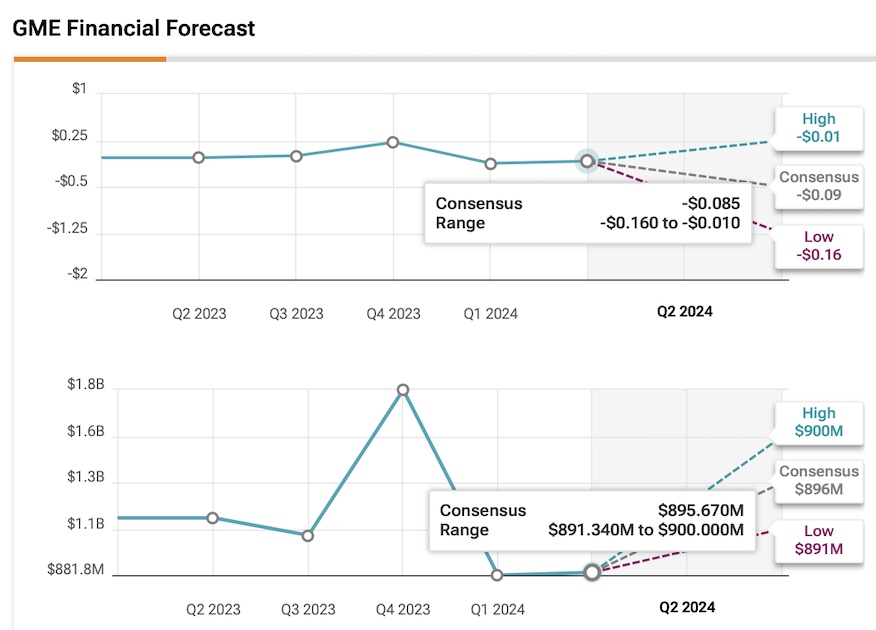

Looking ahead to the upcoming quarterly results, analysts expect GameStop to report a loss per share of $0.09 in Q2 FY24, compared to a $0.03 loss per share in the same period last year. On the revenue side, Q2 is typically a seasonally low quarter for the company’s sales. Analysts have set their expectations at $895.67 million, representing a significant 23% year-over-year decline.

These are certainly not encouraging prospects, but it’s also no surprise that analysts remain discouraged by GameStop’s business fundamentals. With GameStop shares trading at valuations completely detached from market reality – such as an EV/EBITDA ratio of 243x – it’s easy to make a bearish case for a video game retailer experiencing consistent year-over-year sales declines.

Can Ryan Cohen’s Wild Card Revive Q2?

Despite the pessimism surrounding Q2, a major factor that challenges the bearish thesis is GameStop’s unconventional management.

Since Q3 FY23, CEO and largest shareholder Ryan Cohen has hinted at transforming GameStop into a holding company. The company revised its investment policy, which previously allowed investing cash in fixed-income assets, to now include the option to invest in other companies at Cohen’s discretion.

Given that GameStop now holds a substantial cash reserve from recent equity sales and is aiming for breakeven profitability, it seems only a matter of time before a plan for utilizing this cash is announced.

That announcement could potentially come with the Q2 earnings report. For this reason, along with other factors contributing to the stock’s volatility – such as broad support from retail investors – news of new business acquisitions or a pivot into sectors beyond gaming hardware, software, and collectibles could once again act as a major catalyst for GameStop shares.

This could indeed turn GameStop’s Q2 into a significant surprise. However, because this scenario is entirely speculative, it makes sustaining any optimism difficult. Yet, at the same time, it’s too risky to completely ignore.

Is GME Stock a Buy, According to Analysts?

Nearly all analysts have abandoned coverage of GameStop due to its speculative nature and unrealistic valuations. The consensus based on the rating of the remaining analyst, Wedbush’s Michael Pachter, is a Moderate Sell.

In June, Pachter reduced his price target for GME stock from $13.50 to $11 following its Q1 FY24 earnings report. This bearish target suggests a potential downside of nearly 47% based on the most recent stock price.

Key Takeaways

GameStop’s upcoming Q2 earnings are likely to reflect ongoing financial struggles, with anticipated losses and declining revenue. Despite these challenges, the stock has gained notably this year due to meme stock dynamics and recent cash injections from equity sales. The potential impact of CEO Ryan Cohen’s strategic decisions could serve as a key catalyst, though the speculative nature of these developments makes the stock a high-risk investment.