Video game retailer GameStop’s (GME) CEO Ryan Cohen has been slapped with a fine of almost $1 million by the Federal Trade Commission (FTC) to settle charges related to antitrust law violation resulting from his purchase of Wells Fargo & Company’s (WFC) shares. Cohen, who is also the managing partner of RC Ventures and the founder and former CEO of pet goods retailer Chewy (CHWY), failed to report the purchase of his WFC shares in a timely manner.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Here’s Why FTC Fined GameStop CEO Cohen

The FTC has imposed a $985,320 civil penalty on GameStop CEO Cohen as he did not report the purchase of a significant amount of WFC shares to the agency, as required under the Hart-Scott-Rodino Act. In particular, Cohen bought over 562,000 WFC voting securities in March 2018, which led to the aggregated holdings exceeding the Hart-Scott-Rodino filing threshold of $100 million.

The Hart-Scott-Rodino Act requires individuals and companies to report the purchase of securities to the FTC and the Department of Justice (DOJ) beyond a certain threshold, giving the regulators time to investigate the transaction before its completion.

Cohen purchased additional WFC shares between March 2018 and September 2020. Moreover, the FTC noted that Cohen had periodic communications with Wells Fargo’s leadership to suggest the financial services company ways to improve its business. He also sought a board seat at WFC.

CEO Faces Continued Woes at GameStop

The news of the FTC fine comes at a time when Cohen continues to face difficulties in improving GameStop’s prospects. The company recently reported a 31.4% year-over-year decline in its Q2 FY24 sales to $798 million.

The significant drop in the top line reflected that management’s efforts to turn around the business are not reaping the desired results amid macro uncertainties. Additionally, the company announced a stock offering of up to 20 million shares, triggering concerns about further dilution for existing shareholders.

Is GME Stock a Good Buy?

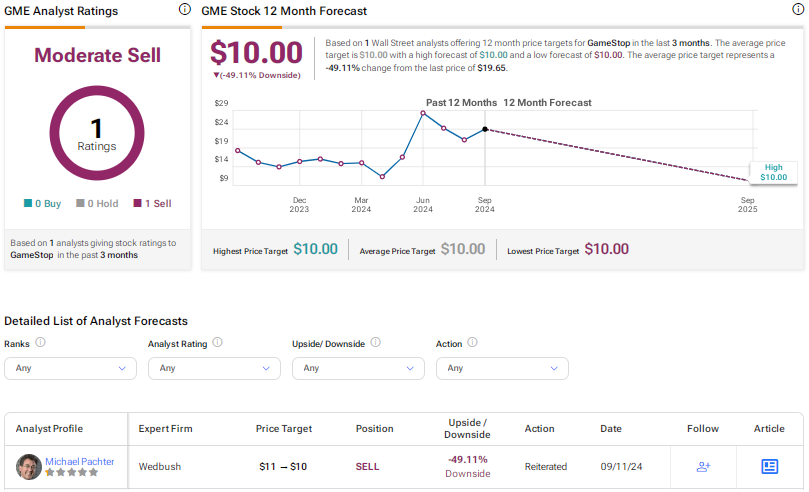

Amid continued challenges, GameStop stock is assigned a Moderate Sell rating based on the Sell recommendation of Wedbush analyst Michael Pachter. His GME stock price target of $10 indicates a possible downside of 49% from current levels. The meme stock has risen 12% year-to-date.