Frontier Group Holdings (ULCC) has shown renewed interest in its merger with struggling ultra-low-cost carrier Spirit Airlines (SAVE). The news sent Spirit Airlines shares up 16.6% in Tuesday’s after-hours trading. The two have reportedly held early-stage discussions of a possible merger although it is not certain that a deal may go through. The news was first reported by the Wall Street Journal.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The deal will be contingent on Spirit Airlines’ ability to restructure its debt with bondholders and its successful navigation through the Chapter 11 Bankruptcy filing. Frontier lost in a shareholder vote to JetBlue Airways (JBLU) in its earlier bid ($2.9 billion) to acquire Spirit Airlines. However, the deal between JetBlue and Spirit ultimately failed as a federal judge blocked the merger in March owing to its monopolistic nature.

Possible Reasons for Frontier’s Interest in Spirit

Spirit’s mounting debt burden and the potential to restructure its soon-to-be-due billion dollars of debt has led to a sharp decline in its share price. Frontier could be betting on getting a cheaper deal this time around, given the massive problems at Spirit.

Last week, Spirit announced that it had won time until December end to refinance its $1.1 billion credit card bonds or stop processing credit card transactions next year. The air carrier has also fully utilized the $300 million left in its existing credit line to meet expenses.

Meanwhile, Frontier is facing its own share of troubles, with over 2,000 pilots threatening to strike if the air carrier fails to improve their pay and benefits. The backdrop for low-cost air carriers has not recovered to the pre-COVID-19 period. Larger carriers are trying to sway customers by offering similar discounted seats and budgeted flying options. Additionally, the unfavorable macro environment and intense competition have led to declining sales and profitability for air carriers.

Is Frontier a Good Stock to Buy?

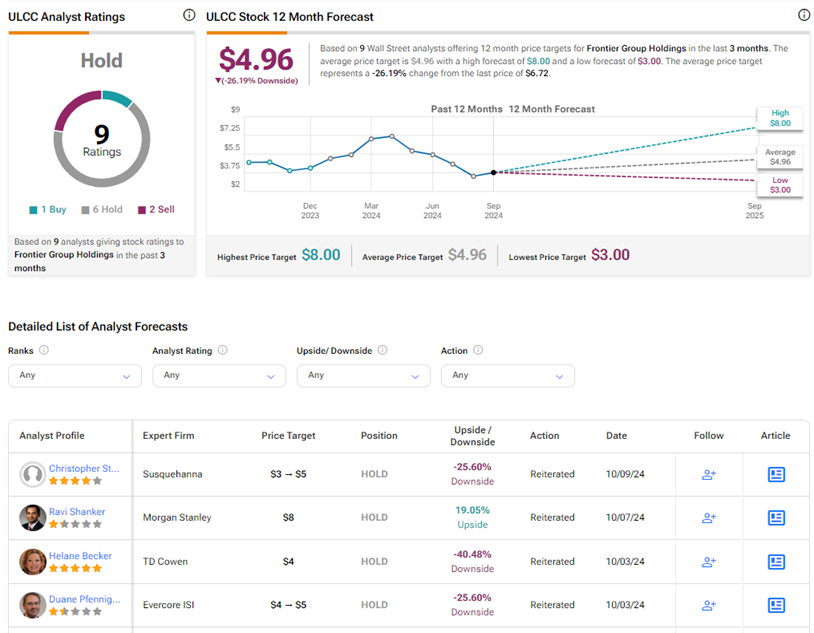

Owing to Frontier Group’s own set of challenges, analysts prefer to remain on the sidelines on the stock. On TipRanks, ULCC stock has a Hold consensus rating based on one Buy, six Holds, and two Sell ratings. The average Frontier Group Holdings price target of $4.96 implies 26.2% downside potential from current levels. Year-to-date, ULCC shares have gained 23%.

What Is the Future of Spirit Stock?

The future of Spirit Airlines stock rests on its ability to negotiate a deal with bondholders and sail through the bankruptcy filing. However, a renewed takeover interest from peer Frontier Group could also help assuage its problems. Either way, analysts remain highly pessimistic on Spirit stock’s trajectory currently.

On TipRanks, SAVE stock has a Strong Sell consensus rating based on one Hold and six Sell ratings. The average Spirit Airlines price target of $2.40 implies 13.7% upside potential from current levels. Meanwhile, SAVE stock has collapsed 86.8% year-to-date, causing massive losses to shareholders.