British businessman Mike Ashley is to step down from the board of Frasers Group (GB:FRAS) which owns iconic High Street brands including House of Fraser and Sports Direct.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares plunged on the news of his departure, dropping to 767.5p from 785p, but recovered slightly in later trading, according to TipRanks Stock Analysis Tool.

Ashley founded his first sports shop in Maidenhead four decades ago, and became a billionaire thanks to his retail empire, before handing his future son-in-law Michael Murray the chief executive role at Frasers Group.

He announced that he will not stand for re-election as director, but will remain as the company’s controlling shareholder, acting as advisor to the board.

Frasers: ‘Strength to strength’

In a statement, Ashley said, “Since Michael Murray took over the leadership of Frasers Group earlier this year, the business has gone from strength to strength. It is clear that the group has the right leadership and strategy in place and I feel very confident passing the baton to Michael and his team.

“Although I am stepping down from the board, I remain 100% committed to supporting Frasers and Michael’s plans and ambitions, and I look forward to helping the team as and when they require me. My commitment and support as a Frasers shareholder is as strong as ever.”

Ashley said that he will provide the Group with £100 million of additional funding.

Four decades in retail

Michael Murray, CEO, said “Mike has built an incredible business over the past 40 years and, on behalf of the Board and the Group, I want to thank him for all he has done. With our new strategy and leadership team, we are driving this business forward at pace and we are all excited for the future. We are grateful to have Mike’s support and expertise available to us as we continue the next stage of Frasers Group’s journey.”

View from the City

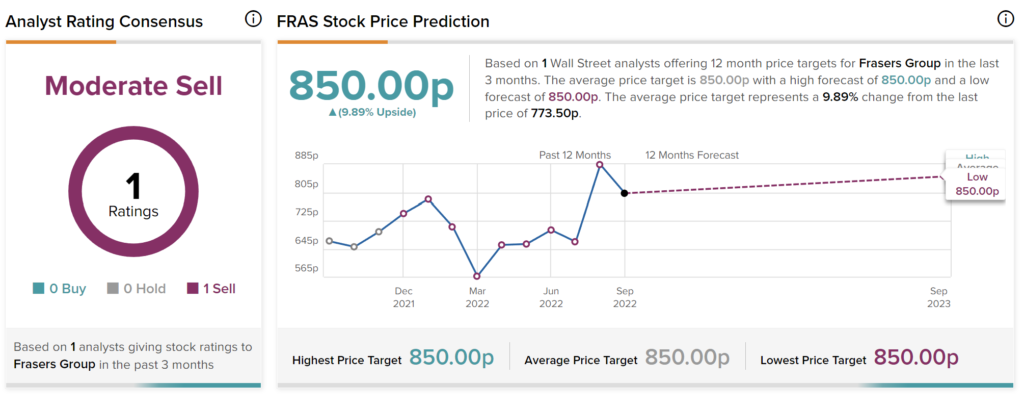

According to TipRanks’ analyst rating consensus, Frasers Group (GB:FRAS) stock has a Moderate Sell rating, based on one Sell rating from analysts.

The average price target is 885p, which is 9.89% higher than the current price level of 773p.

Conclusion

Incoming CEO Michael Murray has big shoes to fill, but with the company re-entering the FTSE 100 after a gap of several years, the retail giant is in a good place.