FTSE 100-listed Frasers Group PLC (GB:FRAS) today announced that it has acquired a 14.65% stake in Australia-based Accent Group (AU:AX1), growing its reach in ANZ (Australia and New Zealand). This marks a crucial step for Frasers in its goal to become a global sports retailer. Frasers’ shares lost 0.93% as of writing.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Frasers Group, established by billionaire Michael Ashley, is a retail company specializing in clothing, sports, and lifestyle products.

Frasers Group Expands ANZ Presence

Frasers’ strategic investment in Accent will expand the company’s presence in the ANZ market. Michael Murray, CEO of Frasers, stated that international growth remains a “key growth driver” for the company and affirmed that this investment aligns with their strategic direction.

As part of this new partnership, Accent Group plans to invite Frasers Group to suggest a director for the Accent Board. This move is aimed at enhancing collaborative opportunities.

Accent has a network of over 800 stores and more than 35 online platforms. In 2024, Accent Group reported sales of AU$1.6 billion across its portfolio of 34 brands. The company distributes international brands like Skechers, UGG, and Vans, in addition to its vertical brands. This deal significantly enhances Frasers’ existing portfolio of fashion and sports brands.

Earlier in May, Frasers increased its investment in Germany-based fashion company Hugo Boss (DE:BOSS).

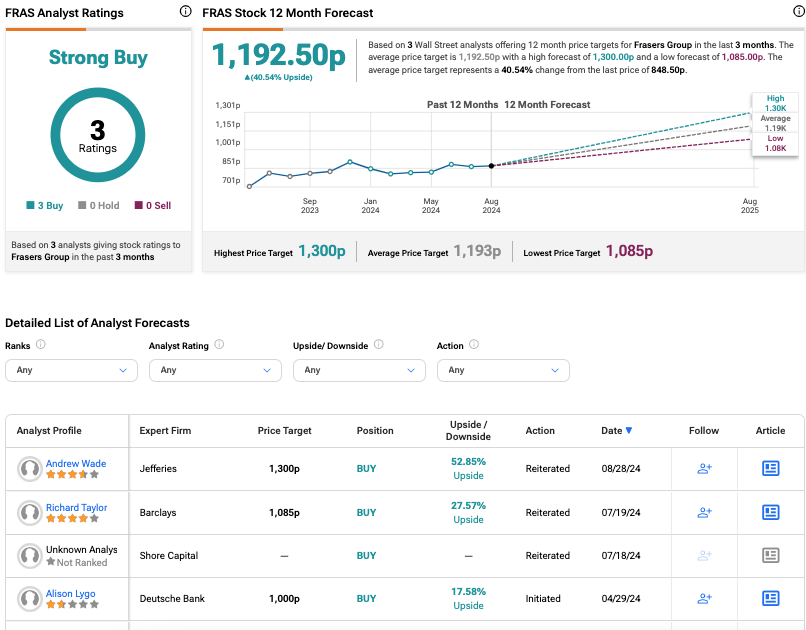

Jefferies Confirms Buy Rating on FRAS

Following the news, analyst Andrew Wade from Jefferies reiterated a Buy rating on the stock. He predicts a nearly 53% upside in the share price. Wade believes that Frasers Group’s current market value doesn’t fully capture the company’s growth potential. This undervaluation, combined with the strategic investment in Accent Group, supports the analyst’s bullish stance.

What Is the Target Price for Frasers?

As per the consensus among analysts on TipRanks, FRAS stock has been assigned a Strong Buy rating based on three Buy recommendations. The Frasers’ share price target is 1,192.50p, which is about 41% above the current level.