The housing market has felt the impact of higher interest rates, with home sales slated to be the lowest since 2012. However, an expected reduction in mortgage rates in the near future could lead to a robust demand for new homes. This anticipation is helping to drive up share prices for real estate development companies such as Forestar Group (NYSE:FOR).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

With its stock up over 162% in the past year, Forestar Group is poised to enjoy ongoing earnings growth and further price appreciation. Despite the impressive rise over the past year, the stock still appears to be a relative value pick, making this a window of opportunity for momentum-oriented investors.

Building Lots for New Housing Construction

Forestar Group is a residential lot development company operating in 57 markets and 23 states. The company primarily acquires entitled real estate and develops it into finished residential lots for sale to homebuilders with a strategic focus on asset turns and efficiency.

The company is a subsidiary of the U.S.’s largest homebuilder by volume, D.R. Horton (NYSE: DHI). A significant portion of D.R. Horton’s homes are built on lots developed by Forestar. The company is also focused on expanding relationships with other national builders, providing a substantial growth opportunity for Forestar, which aims to double its market share to 5% within this highly fragmented industry.

Housing inventory in the U.S. remains at historically low levels, leading the industry to anticipate rising demand for new homes as existing homeowners are likely to continue holding onto their properties in the face of elevated mortgage rates.

Recent Financial Results & Outlook

Forester reported substantial growth in the first quarter of Fiscal 2024. Revenue of $305.9 million exceeded the consensus estimate of $272.37 million. Furthermore, the company’s pre-tax profit margin improved by 380 basis points to 16.7%. Net income increased by 84% to $38.2 million, resulting in an EPS of $0.76 per diluted share, a substantial beat of consensus expectations of $0.50. This impressive performance was mainly attributable to robust residential lot sales, which rose by 39% to 3,150 lots.

The company maintains a solid financial standing with approximately $840 million in total liquidity, sufficient to drive expected growth into the foreseeable future. The company forecasts delivering between 14,500 and 15,500 lots in Fiscal 2024, while aiming to generate $1.4 billion to $1.5 billion in revenue.

What is the Price Target for FOR Stock?

The stock continues to trend upward, climbing over 18% YTD, and demonstrating ongoing positive price momentum as it trades above the 20-day (37.61) and 50-day (35.57) exponential moving averages. Yet despite the price climb, the stock appears to still be relatively undervalued, with an EV/EBITDA ratio of 9.6x, sitting below the Real Estate – Development industry average of 12.1x.

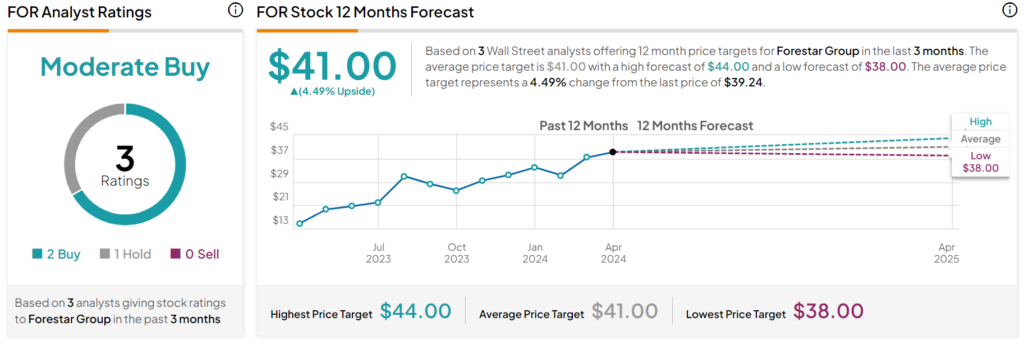

Analysts following the company have been mostly bullish on the stock. For instance, BTIG analyst Carl Reichardt raised the price target on the stock to $41 from $40 in January, and reiterated a Buy rating on the shares.

Forestar Group is rated a Moderate Buy based on the ratings and 12-month price targets three Wall Street analysts issued in the last three months. The average price target of FOR stock is $41.00, which represents a 4.49% upside from current levels.

Final Analysis on Forestar Group

Coming out of the housing market downturn due to higher interest rates, Forestar finds itself in an intriguing position. The Federal Reserve’s expected reduction of interest rates and subsequent decrease in mortgage rates is expected to lead to an uptick in demand for new homes, something already evidenced by the company’s recent financial results. Despite impressive growth in the share price, the stock looks to be a relative value, and could represent an opportunity for growth-oriented investors looking to ride the stock’s positive momentum to new levels.