Legacy U.S. automaker Ford (F) seriously disappointed investors with its dismal Q2 results, leading to a double-digit drop in its share price during the next trading session. My stance on Ford is bearish not just because of the poor quarter but due to a mix of factors including ongoing quality and warranty issues, the complex transition to electric vehicles, and a general lack of investor confidence.

While Ford has taken steps that may help address future warranty issues, I see little reason to be optimistic about the company in the long term.

Ford’s Q2 Earnings Fiasco

Ford shares recently had their worst trading day since 2009, falling around 18% in a single session, after the release of the company’s Q2 earnings results.

Nothing went wrong with the top line, as Ford reported slightly better-than-expected figures at $47.81 billion versus an estimate of $47.79 billion.

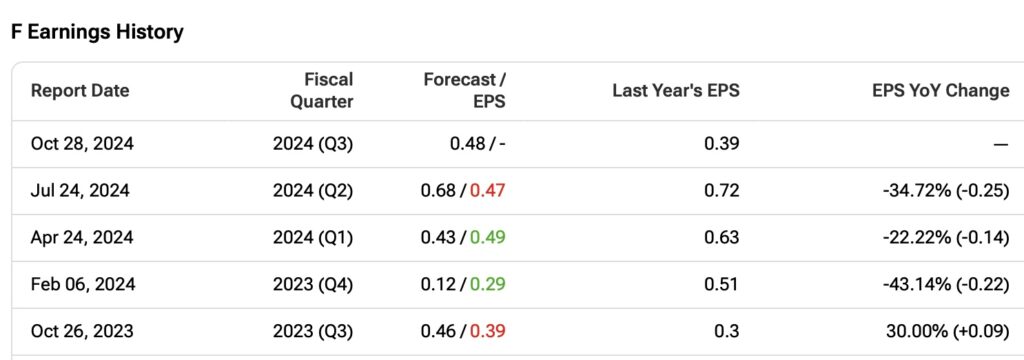

However, the bottom line was ugly. The legacy U.S. automaker shocked investors by reporting a big miss in EPS, coming in at 47 cents when Wall Street was expecting 68 cents. This result meant a year-over-year drop in EPS of 34.7%, marking the third consecutive quarter of sharp double-digit drops year-over-year.

The reason behind this large miss comes down primarily to warranty costs. And these costs hit Ford hard in Q2. Ford Blue, the segment dedicated to Ford’s traditional internal combustion engine (ICE) vehicles, reported EBIT of $1.2 billion, down 48% from the year-ago quarter.

Ford’s CEO, Jim Farley, admitted several times on the earnings call that warranty costs were an issue but also assured that he believes Ford has the networks in place to deal with issues related to quality control and warranties.

Additionally, with the launch of new vehicles, he believes that there will be fewer warranty problems going forward, stating, “We did see warranty costs increase in Q2 tied to new technologies, FSAs, and inflationary pressures for the cost of repair. We expect technology-related margin costs to have now normalized as technology matures and we deploy the capability to address known issues.”

This has been a common problem for Ford over the last few years. Warranty costs have impacted the Dearborn, Michigan-based company, as it has faced challenges related to quality and reliability in some of its new models and technologies. In 2023, for example, Ford had 5.9 million vehicles impacted by recalls, the most of any automaker in the U.S. So, not only are the financial losses a bearish point, but this increase in warranties also suggests a lack of quality in Ford’s combustion vehicles.

Ford, therefore, cut its annual guidance for its Ford Blue ICE division to $6.0-$6.5 billion, slicing about a billion from the previous guidance. On the other hand, Ford increased the guidance for its Ford Pro commercial division, expecting an additional billion dollars in profitability compared to the previous forecast, to between $9 billion and $10 billion.

The Good News: Ford Might Have Hit the Bottom

In my opinion, the best news from Q2 is that the worst is potentially over. As CEO Jim Farley noted, warranty issues should be resolved soon, with a series of measures implemented to make this less of a problem by 2025.

Ford is addressing quality issues by investing in advanced technologies, enhancing testing protocols, collaborating with suppliers, and upgrading software to improve vehicle reliability and performance.

The need to reduce these warranty problems has made Ford take greater precautions and not rush into new launches. For example, Ford’s CEO confirmed in June the delay in a mid-cycle update of the Explorer 2025, Bronco, and Maverick models to have more time to inspect the first units and minimize future problems.

I believe the strong bearish reaction following Q2 makes it clear to the company’s management that this is a critical issue that needs to be addressed. So, it’s reasonable to expect improvements in this area over the next few quarters.

Another positive point for Ford is that despite the drop in EBIT, Ford Blue still grew revenues by 7% in the quarter and 3% in volume, showing that demand is still resilient. Not so positive was another setback for the Ford Model e, as revenues fell by 37%, highlighting weak demand in the EV sector.

Finally, Ford trades at a forward P/E ratio of 5.7x, which is extremely cheap compared to the automotive industry average of around 16x and its own average of 8x over the last five years. However, investors need to be aware that this low valuation doesn’t necessarily mean undervaluation but rather a lack of market confidence due to the several headwinds affecting Ford’s business.

Is F Stock a Buy, According to Analysts?

Despite F stock having a Moderate Buy rating, analysts are divided. Of the 15 analysts covering Ford, seven are bullish, seven are neutral, and one is bearish. After the Q2 results, many analysts revised their price targets downward. The average Ford stock price target is now $14.25, still implying 31.7% upside based on the latest share price.

The Takeaway

First and foremost, Ford will need to prove that its warranty issues have been resolved. Management says this will be addressed in the next few quarters, but the constant setbacks certainly add an extra dose of skepticism for investors.

The company is taking prudent steps to resolve quality problems, and it’s likely that the issues from Q2 will soon be behind it. However, in my opinion, the overall outlook remains bearish. Ford’s quality issues are a major concern due to the firm’s critical importance in the automotive industry. Additionally, the company faces challenges from the complex transition from combustion engines to an electrified fleet, and I don’t expect this transition to be smooth.