Ford Motor (F) is on the cusp of a major reorganization. Citing people familiar with the matter, Reuters reports that the company could be split into two units. One unit will focus on electric vehicle (EV) operations, and the other will focus on internal-combustion engine (ICE) units. F shares fell 4.90% to close at $16.70 on March 1.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Ford is an automobile company that designs, manufactures, and sells cars, trucks, and parts. It develops vehicles under two brands; Ford and Lincoln.

Ford’s Reorganization

The new EV and ICE business units will operate under separate names but will remain under the Ford corporate umbrella. The U.S. automaker will name the executives that will lead the two units and is also expected to outline profit margin targets for the broader company.

The long-term plan is to have Ford deliver separate financial results for the EV and ICE businesses. The reorganization is also part of an effort to fast-track growth in EVs. Separating electric vehicle operations into a separate unit may set the stage for a potential spin-off of the business down the road.

Increased focus on low-carbon technology companies has triggered mounting pressure on carmakers to consider spinning off their electric businesses to enhance their valuations. General Motors (GM) has resisted the calls arguing that ICE business profits will continue to finance its EV transition.

Stock Rating

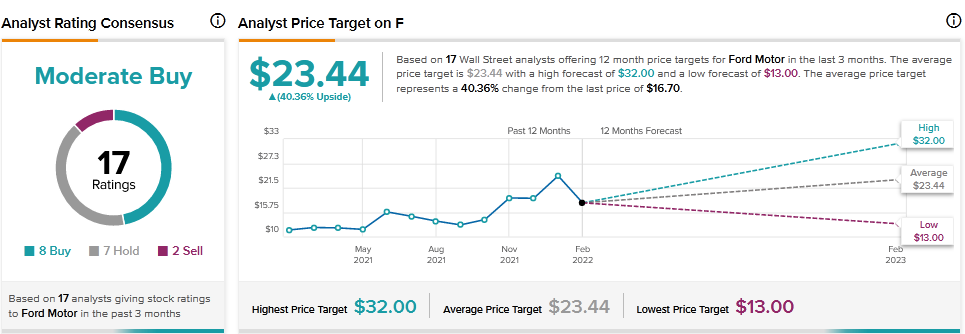

Last month, Wells Fargo analyst Colin Langan reiterated a Buy rating on Ford with a $26 price target, implying 55.69% upside potential to current levels.

Consensus among analysts is a Moderate Buy based on 8 Buys, 7 Holds, and 2 Sells. The average Ford price target of $23.44 implies 40.36% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Report: Rivian Raises Vehicle Prices by up to 20%; Shares Sink 8.4%

Sea Dips 13.1% on Wider-Than-Expected Q4 Loss

Halliburton Opens Inaugural Oilfield Specialty Chemical Plant in Saudi Arabia