Legacy automaker Ford (F) is working to turn around a lot of issues right now. It is working on revamping processes and distribution networks, with even its dealerships being considered for significant updates. And next on the list is manager bonuses, according to CEO Jim Farley. However, Ford investors merely shrugged and sent shares down fractionally in Friday afternoon’s trading.

Ford is focusing on two major metrics right now, a Reuters report noted: improving quality and lowering costs. Given that manager bonuses are tied to these exact metrics, the report noted that said bonuses would be cut by a hefty 65%. Meanwhile, Ford also rolled out a new “performance system” that more closely ties company bonuses to “progress on key goals.”

Nevertheless, there is some time for Ford staff to recover their fourth-quarter bonuses; the reports noted that the company’s fourth-quarter performance would determine the bonus levels involved. In addition, personal performance also has some impact on bonuses at Ford, so the experience is not completely demoralizing as only some portions of bonus amounts are out of the employee’s control.

Slashed Lightning

Further, reports emerged overnight that Ford was planning to pare back production on its F-150 Lightning electric pickup line. In fact, as of November 15, production will be halted altogether on the line and will not start again until January 6, 2025. This, in turn, will see 730 hourly employees furloughed for the rest of the year.

Demand for electric vehicles is falling, a CBS News report noted, with the average price of a new electric vehicle in May standing at $56,648. Two years prior, that was $65,000, showing that people are less willing to pay for an electric vehicle now than just two years ago.

Is Ford Stock a Good Buy Right Now?

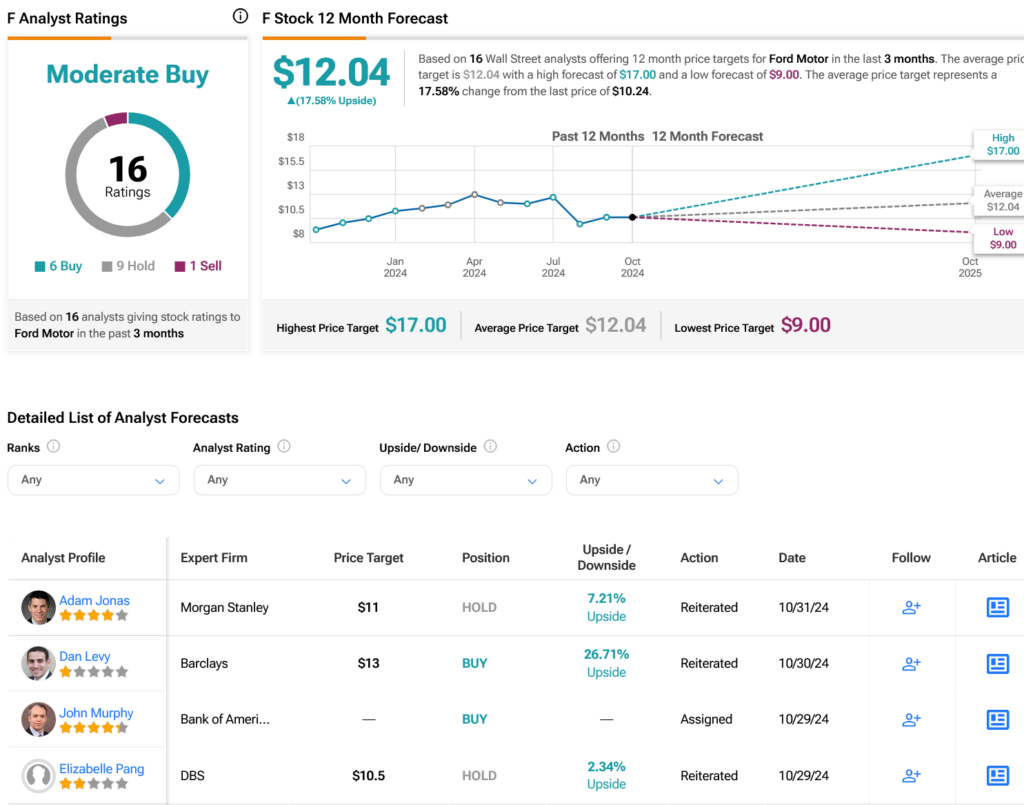

Turning to Wall Street, analysts have a Moderate Buy consensus rating on F stock based on six Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 6.72% rally in its share price over the past year, the average F price target of $12.04 per share implies 17.58% upside potential.