Give automaker Ford (F) credit; it’s putting less emphasis on green initiatives and looking to make some money again. Granted, these aren’t the best times for anyone to look to make money, but Ford is out to make a go of it nevertheless by targeting the fleet market. It didn’t much help share prices, though, which were down around 2% in Monday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Reports note that one of the dirtiest words in a car manufacturer’s lexicon is “fleet.” Fleet sales focus on businesses and governments, such as rental car companies or logistics operations. It can mean big business—fleet buyers buy multiple vehicles in one go—but it can also be troublesome, especially in an era of growing ecological concern.

However, Ford is rapidly working to augment its position in the fleet market while focusing on profitability. Formerly, many automakers used fleet sales as a “dumping ground” for excess inventories. Now, they’re focused on making it an important segment, and it’s starting to produce excellent results. Since 2021, reports note, Ford’s fleet operations have brought in $184.5 billion in revenue. That’s no small feat these days, and one Ford looks to repeat with its “Ford Pro” business.

All This and a New Van

The plan, overall, is great news for Ford, and it’s augmenting its position in this market with a new van that will be co-produced with Volkswagen (VWAPY). The new Transporter and Caravelle model will come with a range of new features and drive systems appropriate to the modern day.

In fact, there’s even some ecological awareness working in here, too, with three different turbodiesel engines available to choose from, along with electric drive and plug-in hybrid alternatives. LED headlights, digital cockpits, and more are all in play and should help drive some of those fleet sales thanks to the sheer range of options.

Is Ford Stock a Buy Right Now?

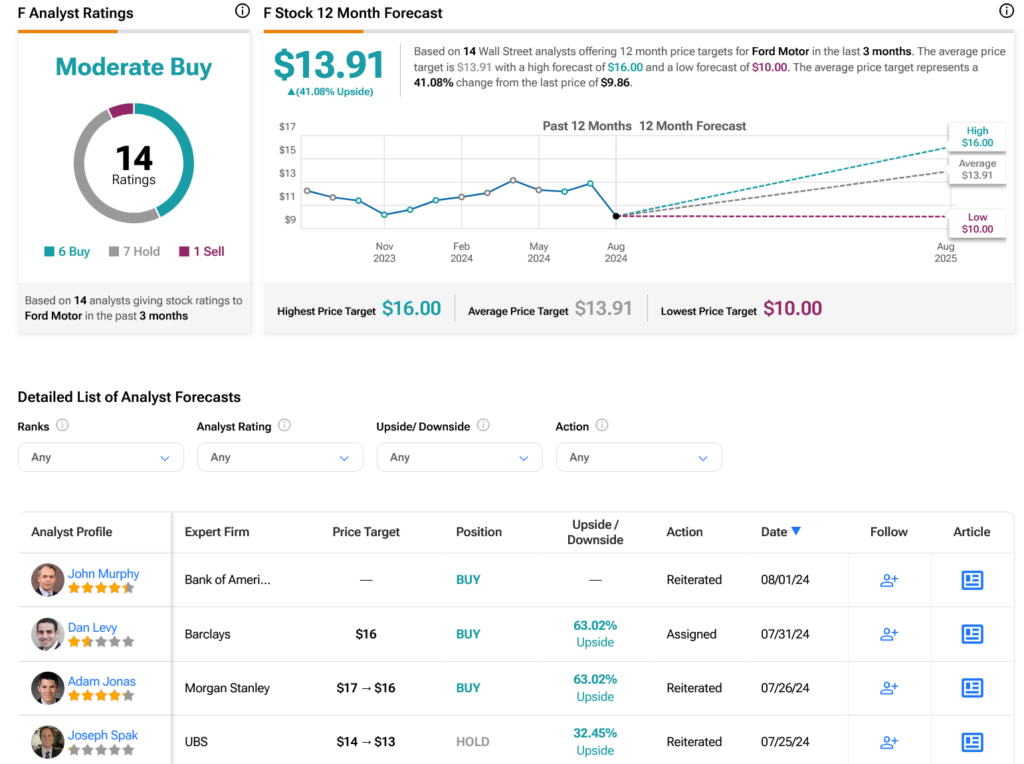

Turning to Wall Street, analysts have a Moderate Buy consensus rating on F stock based on six Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 19.94% loss in its share price over the past year, the average F price target of $13.91 per share implies 41.08% upside potential.