Foot Locker (NYSE: FL), the specialty athletic retailer cratered in pre-market trading after the retailer’s Q2 revenues, excluding foreign currency exchange fluctuations, fell by 10.2% year-over-year to $1.86 billion. This fell short of Street estimates of $1.88 billion. Moreover, comparable store sales in the second quarter declined by 9.4%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

More disappointingly, the company lowered its FY23 outlook and now expects sales to decline by 8% to 9% year-over-year versus its previous estimate of a fall of 6.5% to 8% while comparable store sales are likely to drop between 9% and 10%. Foot Locker has projected FY23 adjusted earnings to be in the range of $1.30 to $1.50 per share as compared to its prior guidance between $2.00 and $2.25 per share.

Adjusted Q2 earnings slid to $0.04 per share as compared to $1.10 per share in the same period last year but were in line with Street estimates.

Foot Locker has hit a pause on its dividends “to increase balance sheet flexibility in support of longer-term strategic priorities” after its recently-approved dividend payout on October 27 to holders of record on October 13.

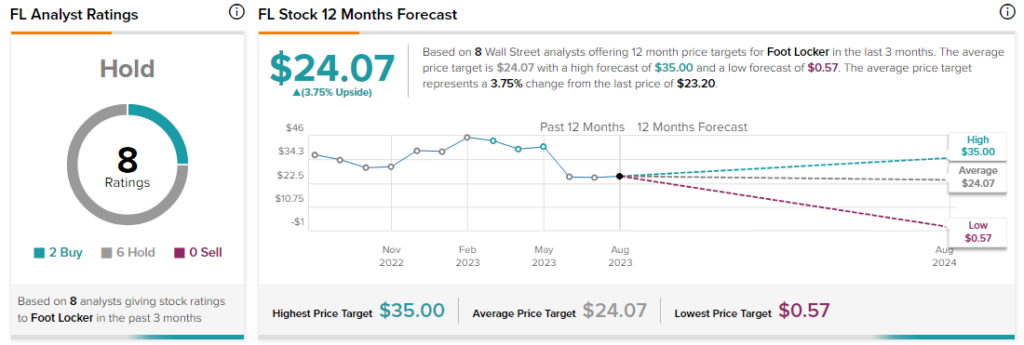

Analysts remained sidelined about FL stock with a Hold consensus rating based on two Buys and six Holds.