Alibaba (NYSE:BABA) undeniably holds its position as a leading tech platform, benefiting from substantial scale advantages. However, given the persistent strong competition, the rate of recovery in consumer and online spending in China remains a concern.

Data from China’s National Bureau of Statistics (NBS) shows that online sales of physical goods grew by a low-single-digit percentage in Q3, likely in the range of 3-5%. While this represents an acceleration vs. Q2, during which sales declined by 3-5%, the growth slowed as the quarter progressed, with year-over-year growth slowing from low-double-digit growth in July to nearly flat in August and September.

In response to this data, Baird’s Colin Sebastian, an analyst ranked amongst the top 3% of Wall Street stock experts, has lowered his revenue forecasts for Alibaba. He now projects FY2025 revenue at ¥1 trillion (a 6.4% increase year-over-year), down slightly from his earlier estimate of ¥1.01 trillion. Similarly, his FY2026 forecast was adjusted from ¥1.09 trillion to ¥1.07 trillion, representing 6.8% growth. However, at the same time, Sebastian has raised his EBITA margin forecasts for FY2025 and FY2026 from 16.4% and 16.3%, respectively, to 16.9% and 16.7%.

“We recognize the macro situation in China is fluid, and there are scenarios in which government stimulus could boost consumer spending, particularly around key shopping holidays,” the 5-analyst went on to say. There are also indicators that imply a “positive early start” to Singles’ Day, though that may only be temporary or reflect “spending pulled forward.”

Possibly more significantly, notes Sebastian, Alibaba remains a company in transition: its core China commerce segment is “stabilizing market share,” international and cross-border commerce is growing steadily, and Cloud growth is accelerating, partly driven by GenAI. “Moreover,” Sebastain summed up, “we believe management is striking a balance between platform enhancements and profitability.”

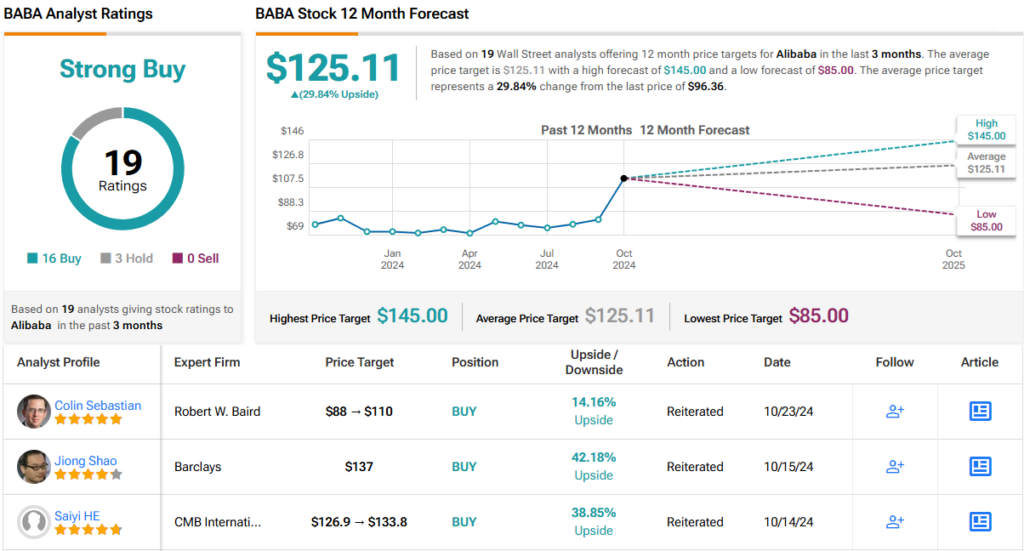

Bottom line, Sebastian rates BABA shares an Outperform (i.e., Buy), and to account for “higher comparable P/E multiples,” he raised his price target from $88 to $110. The new figure offers one-year upside of 14%. (To watch Sebastian’s track record, click here)

Most on the Street agree with that stance; based on a mix of 16 Buys vs. 3 Holds, the analyst consensus rates BABA stock a Strong Buy. The average price target is still more bullish than Sebastian will permit; at $125.11, the figure makes room for 12-month returns of ~30%. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.