Multinational biopharmaceutical company Bristol-Myers Squibb (NYSE: BMY) disclosed that the U.S. Food and Drug Administration (FDA) has approved its Breyanzi (lisocabtagene maraleucel) therapy. It is a CD19-directed chimeric antigen receptor (CAR) T cell therapy to treat adults suffering from large B-cell lymphoma (LBCL), an aggressive form of blood cancer.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, Breyanzi is not recommended for patients with primary central nervous system lymphoma.

Supporting Data

Breyanzi demonstrated significant responses and improved overall survival compared to normal therapy in patients with LBCL that were “primary refractory or relapsed within 12 months after first-line therapy.”

It is the first-of-its-kind CAR T cell therapy that was evaluated for second-line treatment in patients with LBCL in two different studies, Phase 3 TRANSFORM study, and the Phase 2 PILOT study.

The trials showed superior efficacy and a well-tolerated safety profile of the therapy.

Official Comments

SVP at Bristol-Myers Squibb’s U.S. Hematology, Ester Banque, said, “As part of our commitment to developing innovative cancer treatments for patients with critical unmet need, Breyanzi offers a potentially curative option for more patients. Based on the demonstrated clinical benefit, this approval of Breyanzi underscores the significant advances we are making to deliver on the promise of cell therapy.”

Other Developments

According to Reuters, U.S. District Judge Jesse Furman in Manhattan recently rejected Bristol-Myers Squibb’s claim to dismiss a $6.4 billion lawsuit.

The lawsuit accused the company of intentionally delaying its Breyanzi cancer drug to avoid payments to shareholders of Celgene Corp, which it acquired in 2019. However, the drugmaker claimed that UMB Bank NA, acting as the trustee for shareholders, did not notify the company about its defaulted merger obligations.

No immediate response was released by Bristol-Myers.

Wall Street’s Take

Recently, Bank of America Securities analyst Geoff Meacham reiterated a Buy rating on the stock and raised the price target to $80 from $78. This indicates a 1.32% upside potential from Friday’s closing price of $78.96 per share.

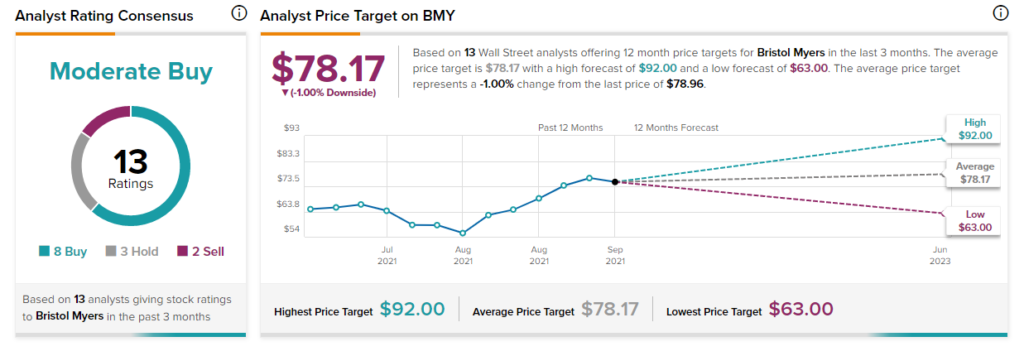

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys, three Holds, and two Sells. That’s alongside an average Bristol-Myers Squibb price target of $78.17, which implies 1% downside potential to current levels. Shares have increased 22.72% over the past year.

Smart Score

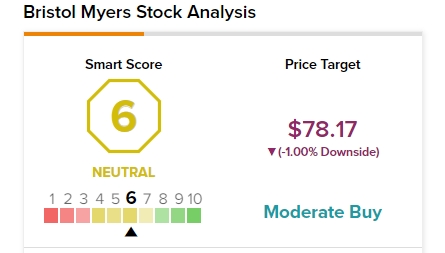

According to TipRanks’ Smart Score system, Bristol-Myers Squibb gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

Bottom-Line

In the current uncertain economic environment, the healthcare sector has demonstrated greater resilience than many other sectors. Therefore, with recent price gains and positive clinical developments, Bristol-Myers Squibb can be considered for potential long-term returns.

Read full Disclosure