Faraday Future Intelligent Electric (FFIE), an industry pioneer in smart electric vehicles and related products, is capturing attention with a recent 30% share surge following a new $30 million financing commitment from Middle Eastern, American, and Asian investors. Furthermore, the company has successfully executed a reverse stock split, securing its listing on the Nasdaq Stock Market by regaining compliance with all listing requirements.

Faraday Future uses AI and software technologies to position itself in the global market. It is also making ongoing efforts to secure financing to expand its product and delivery capabilities. The company’s unique value proposition lies in its innovative bridge value strategy that combines the strengths of the U.S. and Chinese automotive industries, forming a distinctive competitive edge for the AI electric vehicle market.

It is still in the early days, and the company has some distance to travel to have a viable product that can be produced at scale, but it is an intriguing potential disruptor in the space worth watching.

Faraday Future Expands into Asia & the Middle East

Faraday Future Intelligent Electric is a California-based technology company that creates, markets, and distributes AI-powered electric vehicles and related products. The company adopted a different approach to vehicle technology, focusing on a variable platform architecture, a cutting-edge propulsion system, and autonomous driving and intelligence systems. It also coordinates manufacturing efforts with its South Korean partner and is preparing to expand its manufacturing capabilities in China through a joint venture agreement.

At the beginning of 2024, the company introduced the China-U.S. Automotive Bridge Strategy. This strategy aims to expand the company’s reach into multiple market segments by leveraging advanced AI and software technologies. The approach involves returning to a dual-brand value proposition that combines the strengths of the U.S. and the Chinese automotive industries.

Faraday Future aims to offer a solid value proposition in the AI EV mass market by enhancing procured components with its proprietary AI and vehicle software technology. It also enables savings through the in-house manufacturing of the FF 91 vehicle body.

Faraday Future also launched a Middle East sales entity based in Dubai, an essential step in its growth plan. The move also helped it secure a financial commitment of $30 million with Master Investment, led by Sheikh Abdulla Al Qassimi from the UAE.

Faraday Future’s Recent Financial Results

The company has shown significant improvement in its financial operations, as evidenced by a substantial decrease in operating expenses from $49.4 million in Q2 2023 to $29.9 million in the most recent quarter. Additionally, operations losses have decreased from $56.0 million to $50.6 million within the same time frame. In the six months ending June 30, 2024, there was a marked improvement in cash outflow from operations, decreasing from a $160.7 million outflow to just $29.1 million.

In addition to securing $30 million in capital commitments, the company generated approximately $15.5 million in gross financing via convertible debt. As of the end of the second quarter of 2024, the company’s balance sheet depicted assets valued at $457.9 million and liabilities amounting to $309.2 million, resulting in a book value of $148.7 million.

Looking ahead, the company is focusing on boosting vehicle production and delivery levels – to date, it has only delivered 13 vehicles.

Is FFIE a Buy?

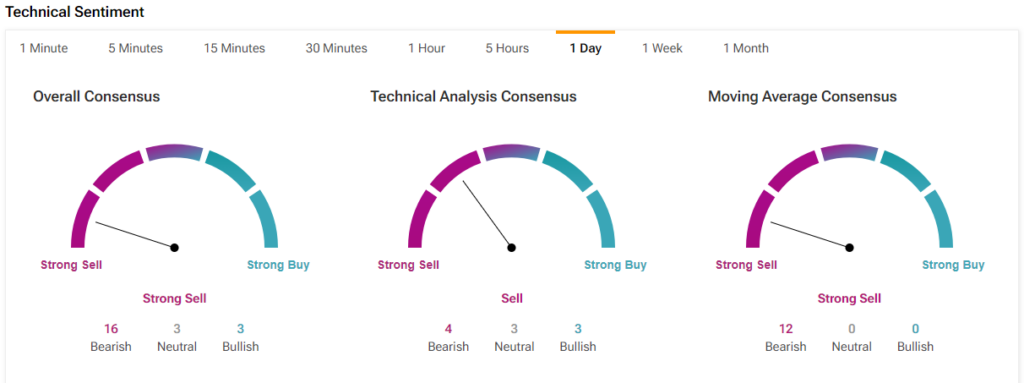

The stock is highly volatile, with a beta of 7.58. While the post-new cycle stock surge has grabbed attention, the stock is down over 80% in the past 90 days. It demonstrates negative price momentum by trading below its 20-day (5.63) and 50-day (9.20) moving averages.

This is a highly speculative endeavor, and the stock is not for most investors. Yet, for those with a risk appetite and willing to endure the rollercoaster ride, it may have a lotto ticket appeal.

FFIE in Final Analysis

Faraday Future Intelligent Electric is a pioneer in developing smart electric vehicles and continues to push forward through AI innovation and software tech. Although still in its early stages, the company is committed to expansion through its strategic partnerships and has showcased a marked improvement in its financial operations. However, the stock remains highly volatile, making it a high-risk, high-reward venture for potential investors willing to speculate on a potential disruptor.