Oil and gas giant Exxon Mobil (XOM) will release its fiscal Q2 financials on August 2. Analysts expect to report earnings of 2.02 per share, up 4% from the prior-year quarter. Meanwhile, they expect revenues of $90.09 billion, reflecting a 12% year-over-year increase, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In terms of share price, XOM’s stock has gained by nearly 15% over the past year, driven by high oil and gas prices. However, with energy prices now normalizing, the company’s bottom line is facing pressure. Additionally, shrinking margins and falling natural gas prices are impacting profits.

Interestingly, Exxon missed EPS estimates in three of its last four quarterly earnings due to the challenges posed by a volatile energy market.

Factors to Consider Ahead of Q2

Even though the analysts expect a year-over-year increase in earnings and revenues, the uncertainty in the energy market and declining natural gas prices could act as dampeners in Q2.

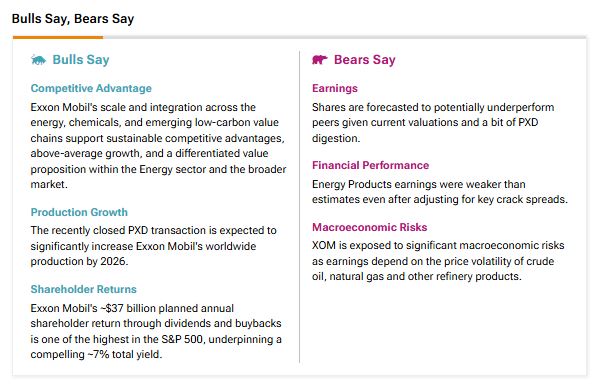

Also, according to TipRanks’ Bulls Say, Bears Say tool, bears pointed out that XOM faces significant macroeconomic risks as its earnings are heavily influenced by the price volatility of crude oil, natural gas, and other refinery products. However, bullish analysts believe that XOM’s recent acquisition of Pioneer Natural Resources should boost XOM’s worldwide production by 2026.

Despite higher production, Exxon warned in July that weak refining margins and low natural gas prices would hit its earnings in Q2. The oil giant now expects its second-quarter earnings to decline sequentially by $300 million to $700 million.

Having said that, it will be interesting to see if Exxon can report a Q2 beat on both the top and bottom line fronts.

Options Traders Anticipate a 1.14% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 1.14% move in either direction.

Is Exxon Mobil Stock a Buy or Sell?

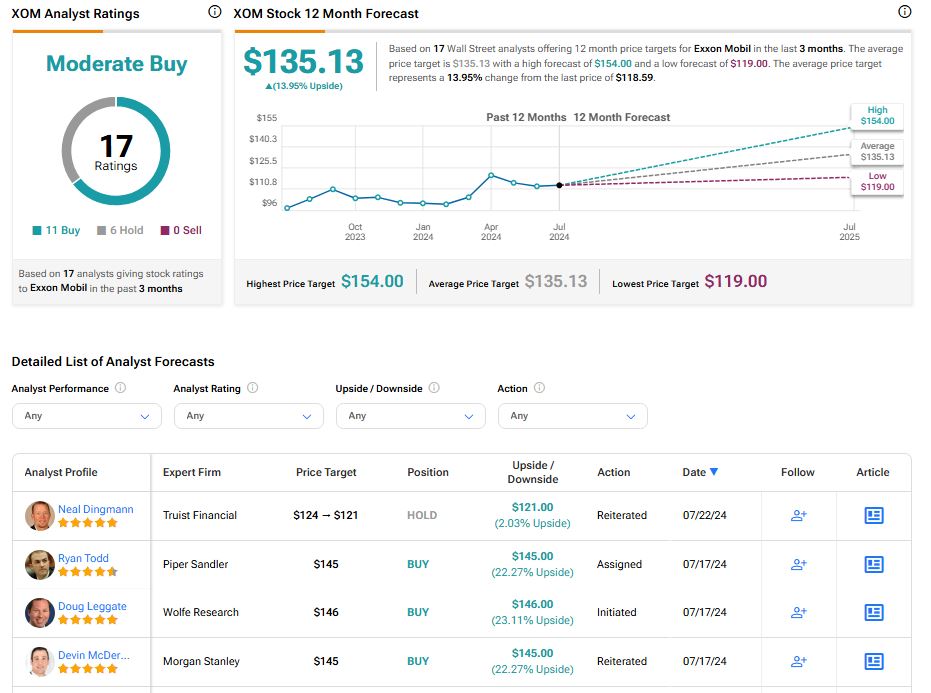

Overall, the Street has a Moderate Buy consensus rating on Exxon Mobil, alongside an average price target of $135.13. However, analysts’ views on the stock are likely to change once the company reports its Q2 earnings tomorrow.

Bottom Line

Analysts expect Exxon’s top and bottom lines to improve year-over-year in Q2. Nonetheless, the results may take a hit due to volatility in the energy market and falling natural gas prices.