While much of the United States is looking toward November 5 with at least some kind of anticipation—even if only the anticipation of it finally being over—oil stock Exxon Mobil (XOM) is taking a much more sedate path. In fact, it looks for little, if any, change, a sentiment echoed by shareholders, who sent Exxon Mobil shares down fractionally in Friday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Exxon CEO Darren Woods made it pretty clear: “I’m not sure how drill, baby, drill translates into policy.” This is true, to a point; after all, Woods noted that United States shale production is already largely unconstrained by “external restrictions” and has already produced record amounts of oil and gas. Indeed, over the last six years, the United States actually managed to outproduce both Saudi Arabia and Russia.

However, Woods notes that an “economic environment” may prompt change, which makes sense enough. Should oil and natural gas prices increase, Exxon Mobil would respond by producing more to take advantage accordingly. And though there are some issues in terms of federal permits that keep some resources out of play—like in the Gulf of Mexico—there are still places to drill and seek oil.

Selling Off Assets

Indeed, Exxon Mobil is likely less than worried about finding places to drill, baby, drill, as it recently sold off a set of its assets to Pluspetrol. Exxon Mobil sold the Vaca Muerta formation assets, located near Argentina, to Pluspetrol, which includes five blocks in the Neuquen province. It also includes Exxon Mobil’s stake in Oleoductos del Valle, a pipeline operator.

Neither Exxon Mobil nor Pluspetrol would offer up details on the transaction, like how much it would have been worth or when the transaction would conclude. However, in a Reuters report, representatives for Exxon Mobil noted, “We continue to work together with the buyer and the Neuquen government to achieve alignment on the desired results.”

Is Exxon Mobil Stock a Good Buy Right Now?

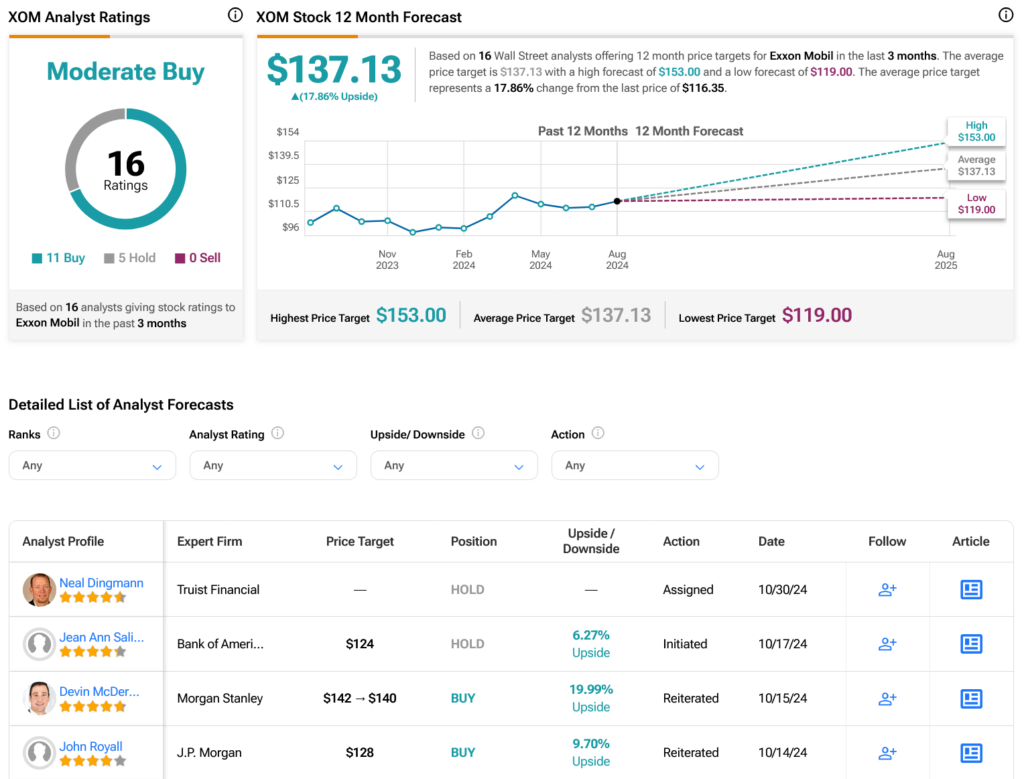

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XOM stock based on 11 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 9.81% rally in its share price over the past year, the average XOM price target of $137.13 per share implies 17.86% upside potential.