Expedia (NASDAQ:EXPE) shares gained nearly 16% in the morning session today after the online travel solutions provider’s third-quarter EPS of $5.41 exceeded expectations by $0.41. Further, revenue of $3.93 billion clocked a year-over-year increase of 8.6%, outpacing estimates by $70 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amid healthy travel trends, Expedia is witnessing growth in both its business-to-business and business-to-consumer verticals. During the quarter, lodging gross bookings rose by 8% to $18.5 billion. The company experienced healthy year-over-year growth in its Lodging as well as Advertising and Media product categories, with an uptick across its U.S. and non-U.S. points of sale geographies.

This robust sales growth also helped Expedia deliver an adjusted EBITDA of $1.2 billion, representing a 13% year-over-year growth for the quarter. Moreover, the company has announced a new share repurchase program worth $5 billion. The new share buyback authorization comes on top of the 17 million shares Expedia has bought back so far this year for nearly $1.8 billion.

Is EXPE Stock a Good Buy?

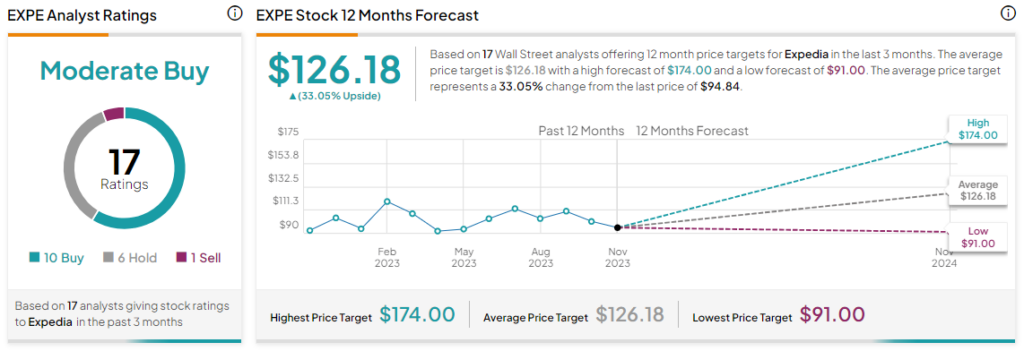

Overall, the Street has a Moderate Buy consensus rating on Expedia. The average EXPE price target of $126.18 implies a mouth-watering 33% potential upside. Despite today’s price gains, Expedia shares still remain nearly 25% lower over the past five years.

Read full Disclosure