Evolus (NASDAQ:EOLS) has emerged as a key player in the medical aesthetics industry, with a popular product challenging Botox’s market dominance. The brand’s outstanding growth and promising expansion plans into new markets bode well for projected profitability in 2024 and long-term revenue forecast. Despite recent fluctuations in share price and a potential share dilution, Evolus’ robust growth trajectory holds appealing potential for investors looking for a play in the rising medical aesthetics industry.

Growing Market Share

Evolus specializes in medical aesthetic treatments and procedures, circulating its products to physicians and patients. Renowned for its product Jeuveau, the brand has gained a reputation as a prominent competitor to Botox and gained the tag of the fastest-growing toxin in the United States aesthetic market for the past three years.

The company’s preliminary sales figures show solid operational strength and significant market share gains, backed by a strong presence in the U.S. neurotoxin market, mainly driven by Jeuveau. The company is diversifying its portfolio by introducing dermal fillers that are set to launch in the U.S. and Europe in 2025. This move could increase the company’s total addressable market by 78% to nearly $6 billion.

The industry is projected to experience a substantial annual growth of 14% through 2026. The key drivers behind this surge include an increasing patient base owing to greater awareness and acceptance of aesthetics on social media, a rise in establishments offering aesthetic services, an expansion of indications, the uptake of novel technologies, and the emergence of new service delivery channels tailored to consumer needs.

Robust Outlook

Evolus recently posted its Q4 results, reporting revenue of $61 million, slightly surpassing the consensus of $60.06 million. However, earnings per share came in at -$0.21, notably missing the -$0.07 consensus. For the entire year, Evolus generated revenue of $202 million, a 36% increase over the previous year. A key factor for this growth is higher sales volume in the U.S., which makes up more than 90% of its total revenue.

Management expects the company to be profitable by the fourth quarter of 2024 and for the entire year of 2025. They project FY24 revenue to be between $255 million and $265 million, with the consensus being $261.17 million. The company also projects an FY24 adjusted gross profit margin of 68% to 71%.

In its long-term forecast, the company estimates a minimum of $700 million in revenue by 2028. This suggests an ambitious compound annual growth rate of 28%.

Where the Stock Stands Now

EOLS stock has been trending up over the past year, with the shares rallying 65.8%. Its recent price is trading toward the higher end of the 52-week range of $7.07-$15.43. Positive price momentum has slowed of late, with the shares trading just around the 20-day moving average (13.99), though still above the 50-day moving average (13.09).

With the steady climb in price, the stock appears richly valued based on comparative metrics. The P/S ratio (3.93x) sits above the averages for the Healthcare sector (1.97x) and the Drug Manufacturers – Specialty & Generic industry (2.1x).

Evolus recently announced an underwritten offering of 3.55 million shares of its common stock, set at a price of $14.07 per share. The projected gross proceeds from this offer stand at approximately $50 million. As the company’s overall value is now dispersed among an increased pool of shareholders, the value of existing shares may be diluted.

What is the Target Price for EOLS?

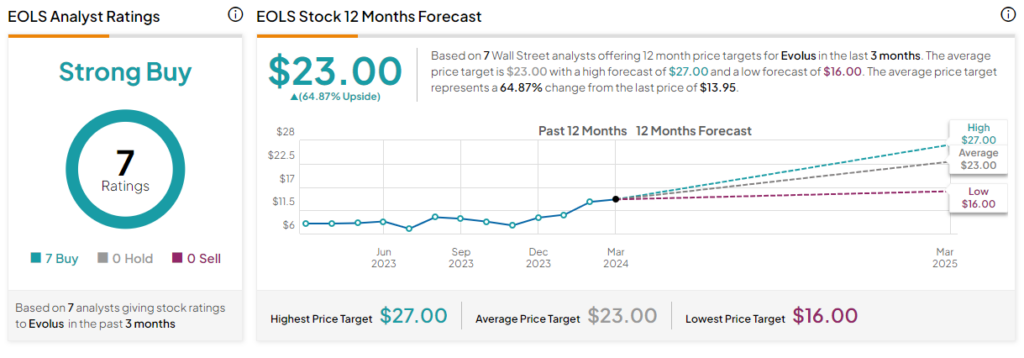

Based on seven analysts’ Buy ratings in the past three months, Evolus is listed as a Strong Buy. The average EOLS 12-month price target of $23 represents an upside potential of 64.87% from current levels.

Analysts covering the stock have been consistently bullish, with many recently making positive adjustments to price targets. For example, Stifel analyst Annabel Samimy increased the price target from $23 to $25 and reiterated a Buy rating on the shares, citing the company’s robust 2024 revenue guidance, which indicates growth significantly above the market average.

The Big Picture for Evolus

Evolus has demonstrated a solid growth trajectory rooted in operational strength and a popular product offering. The planned launch of dermal fillers in the U.S. and Europe opens up new revenue streams, positioning the company toward robust revenue growth and projected profitability later this year.

Despite a temporary slowdown in its price momentum and the potential share dilution from the recent offering, the stock appears to hold strong upside potential, particularly if the company can hit its long-term CAGR forecast of 28% through 2028. For growth investors willing to pay a bit of a premium, Evolus could be a compelling investment in the steadily growing medical aesthetics industry.