Eventbrite (NYSE:EB) is a leader in the self-service ticketing and event technology industry. Despite a challenging period during the pandemic, the company has bounced back with renewed vigor, handling ticketing and promotion for over 5 million events last year. The current valuation level and a proposed $100 million stock repurchase program position EB stock attractively for value investors looking for portfolio exposure to the growing event experience industry.

Psst…Wanna Buy a Ticket?

Eventbrite’s core services include event management, online ticketing, event hosting, organization, promotion, and advertising. The platform integrates the necessary components for seamless event planning, promotion, and production and significantly reduces costs and friction while amplifying reach and ticket sales.

COVID was challenging for Eventbrite, as public events shut down nationwide, and the company was eventually forced to lay off almost half its employees. Since then, the company has rebounded due to the renewed desire for “experiences” following the reopening of the economy.

The event ticketing space is highly competitive, and the firm continues to face significant challenges with rivals securing exclusive deals.

Q4 Results and Outlook

Eventbrite recently released its Q4 earnings, reporting an EPS of -$0.01, outperforming the consensus of -$0.05. Despite falling slightly short of the predicted Q4 revenue of $88.53 million with a reported $87.76 million, the company has boasted a record-breaking quarter and strong double-digit revenue growth for the past year.

Julia Hartz, Co-Founder, and Chief Executive Officer, credited recent success to the company’s marketplace strategy, adding that 2023 saw them selling over 300 million free and paid tickets. Eventbrite’s community now includes over 91 million event attendees and nearly 1 million event creators.

Looking forward, Eventbrite expects net revenue for Q1 of 2024 to range between $84 million and $87 million, falling slightly short of the consensus at $89.18 million. For the full year, the company expects revenue between $359 million and $372 million, again under the predicted consensus of $398.4 million. Despite these lower revenue predictions, Eventbrite expects to maintain its adjusted EBITDA margin in the low-to-mid teens for 2024.

Where the Stock Stands Now

EB stock was relatively range-bound for much of the last year until the Q4 results were announced, which led to the shares sliding by 31.68% in the past 90 days. The recent price of $5.50 is trading toward the bottom of its 52-week range of $5.05-$11.90. The shares demonstrate ongoing negative price momentum, trading below the 20-day (6.22) and 50-day (7.13) moving averages.

Based on comparative metrics, Eventbrite stock is relatively undervalued. The P/S of 1.69x is well below the Technology sector (4.61x) and Software-Application industry (6.97x) averages.

Eventbrite has announced a program to repurchase up to $100 million of its Class A common stock. The execution of these repurchases will depend on market conditions and may involve various methods, such as open market transactions or private deals, giving the company maximum flexibility to support the share price.

Is EB stock a Buy?

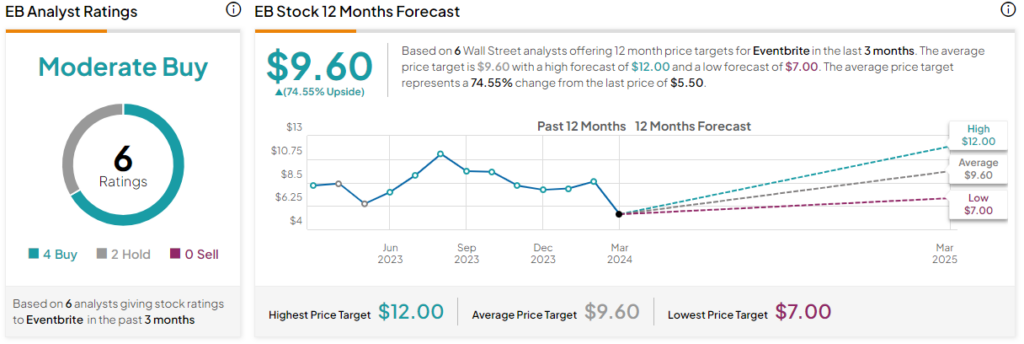

Analysts covering EB stock have taken a cautiously optimistic view. However, many have lowered their price targets for the stock based on headwinds associated with a recent transition in organizer fees. Many see this as a transitory issue that will only impact the near term.

Based on six analysts’ stock ratings in the past three months, Eventbrite is listed as a Moderate Buy. The average EB stock price target of $9.60 represents an upside potential of 74.55% from current levels.

Final Thoughts

Eventbrite remains an intriguing proposition for value investors interested in the events and experiences sector. The company’s integrated platform, which fuels experiences and events worldwide, positions it to navigate a competitive landscape. Variables at play include slightly lower-than-anticipated revenue figures and a recent stock slide following Q4 results.

Yet, the company’s repurchase program shows a commitment to supporting the share price. If the company can overcome transient issues with changes to ticket charges, there is potential for longer-term strong upside performance.