Ethereum’s layer-2 (L2) networks have surged past $51.5 billion in cumulative total value locked (TVL), marking a staggering 205% increase since November 2023, according to L2beat. These scaling solutions, which process transactions on secondary chains to ease congestion on Ethereum’s mainnet, are redefining the way the ecosystem handles scalability.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Arbitrum and Base Drive the Surge

Leading the pack, Arbitrum (ARB-USD) holds $18.3 billion in TVL—35% of the total L2 ecosystem—while Base secures the second spot with $11.4 billion. Over the last week, Arbitrum’s TVL climbed 12%, and Base followed closely with an 11.4% increase. Impressively, Base surpassed 106 transactions per second (TPS) on November 26 and recently crossed the one-billion-transaction milestone, fueled in part by memecoin hype during the current bull cycle.

Dencun Upgrade Bolsters Fee Stability

March’s Dencun upgrade, Ethereum’s largest since the Merge, played a crucial role in stabilizing L2 fees. Nick Dodson, CEO of Fuel Labs, told Cointelegraph the upgrade isn’t just about fee reductions: “It’s actually more about expanding capacity and scale.” L2s like Starknet and Optimism saw a 99% drop in median transaction fees post-upgrade.

Debates on Mainnet Revenue Emerge

Despite these gains, some worry L2s could undermine Ethereum’s mainnet revenue. Critics have called them “cannibalistic,” suggesting their growth may limit Ether’s price potential. However, with L2s enhancing scalability, investor interest in Ethereum-native assets continues to rise.

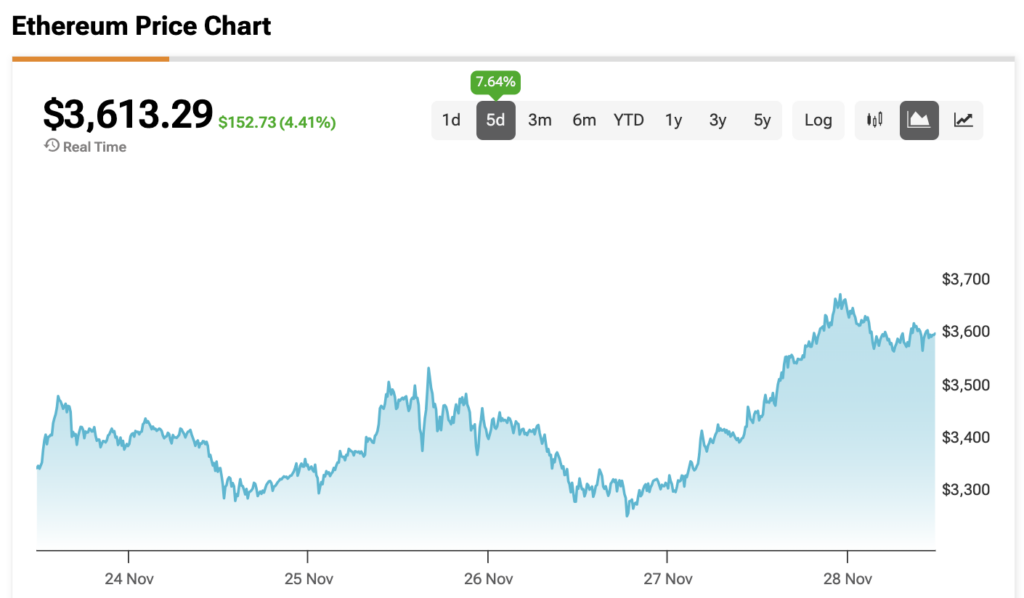

At the time of writing, Ethereum is sitting at $3,613.29.