Emerson Electric Company (NYSE: EMR) has disclosed plans to sell its Therm-O-Disc sensing and protection technologies business to an affiliate of One Rock Capital Partners, LLC. The financial terms of the deal remain undisclosed so far.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company engages in the designing and manufacturing of engineering and technology products for industrial, commercial, and consumer markets worldwide.

Therm-O-Disc deals in highly engineered sensors and hermetic feedthroughs for blue-chip customers in the HVAC, appliance, industrial, automotive, and aerospace and defense markets.

The transaction, though still subject to regulatory approvals and other customary closing conditions, is expected to close in the second quarter of 2022.

Meanwhile, Emerson said that it will be working closely with One Rock to help ensure a smooth transition for customers and employees.

For the transaction, Emerson has Evercore as its financial advisor and Davis Polk & Wardwell LLP as legal counsel.

Price Target

Last month, Wells Fargo analyst Joseph O’Dea maintaining a Hold rating on Emerson and raised the price target to $102 from $100. The new price target implies 9.4% upside potential from current level.

Based on 4 Buys and 7 Holds, the stock has a Moderate Buy consensus rating. The Emerson stock price prediction of $109 implies 16.9% upside potential from current levels. Shares have gained 7.6% over the past year.

Risk Analysis

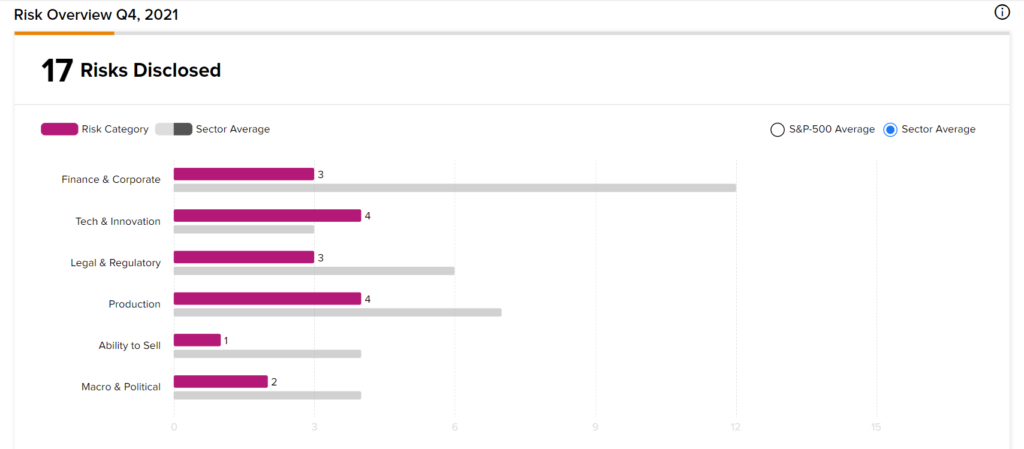

According to the TipRanks Risk Factors tool, EMR is at risk mainly from two factors: Tech and Innovation and Production, which account for four risks each of the total 17 risks identified for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Broadcom’s Q1 Results Surpass Estimates; Street Says Buy

Moderna to Open Enterprise Solutions Hub in Atlanta

Okta Declines 5.6% Despite Better-Than-Expected Q4 Results