American pharmaceutical company Eli Lilly and Company’s (NYSE: LLY) COVID-19 antiviral treatment, bebtelovimab, has received authorization for emergency use from the U.S. Food and Drug Administration (FDA) for people aged 12 years and older, and weighing at least 40 kg. The drug has demonstrated neutralization against the Omicron variant.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bebtelovimab is designed to treat mild-to-moderate COVID-19 in adults and pediatric patients, with positive results of direct SARS-CoV-2 viral testing. These patients also include individuals at high risk for progression to severe COVID-19, and for whom FDA-approved alternative COVID-19 treatments are not accessible.

Supporting Data

The U.S. regulator’s decision was based on the analysis from the Phase 2 BLAZE-4 trial (NCT04634409), treatment arms 9-14. The trial was designed to study the authorized dose of bebtelovimab (175 mg) separately or when administered along with bamlanivimab and etesevimab for the treatment of mild to moderate COVID-19 in non-hospitalized patients.

This data shows that the therapy retains full neutralization activity against the Omicron variant, and also retains neutralization against all other known variants, including BA.2.

Remarkably, Lilly has already inked a deal with the U.S. government for the supply of 600,000 doses of investigational drug bebtelovimab for $720 million.

Official Comments

Eli Lilly’s CMO Daniel Skovronsky said, “With the emergence of variants such as Omicron, treatment options remain limited. Lilly is pleased to provide another treatment option to help address the ongoing needs of patients and health care providers who continue to battle this pandemic.”

Analysts’ Recommendation

Recently, Morgan Stanley analyst Matthew Harrison reiterated a Buy rating on the stock but reduced the price target to $265 (12.88% upside potential) from $272.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 11 Buys and 5 Holds. The average Eli Lilly price target of $289.94 implies 23.50% upside potential. Shares have gained almost 25% over the past year.

Risk Analysis

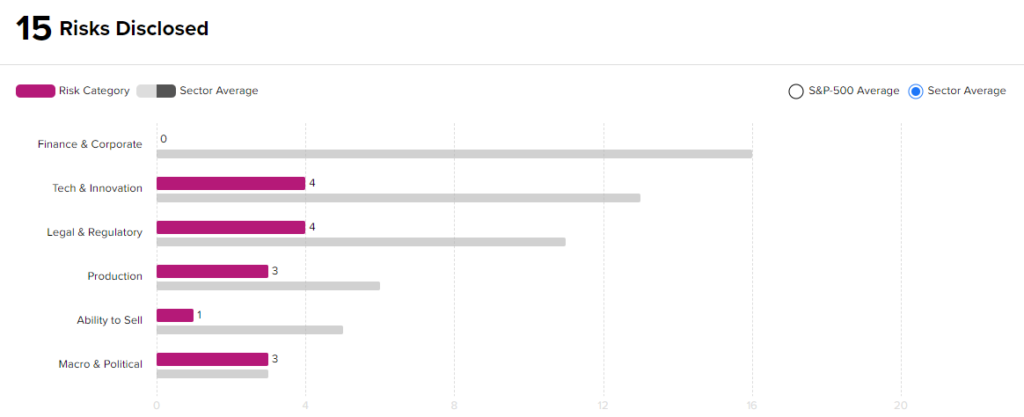

According to the new TipRanks Risk Factors tool, Eli Lilly stock is at risk mainly from two factors: Tech and Innovation, and Legal and Regulatory, which contribute 4 risks apiece to the total 15 risks identified for the stock.

At 15 risks, Eli Lilly is at considerably lower risk than other companies in its industry. Given its lower-risk profile and positive clinical development, investors might consider adding Eli Lilly to their portfolios.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AstraZeneca’s Q4 Results Outperform; Shares Rise Pre-Market

Coca-Cola Posts Better-than-Expected Results as Sales Outperform

Novavax Reveals Positive Results for NVX-CoV2373 in Pediatrics