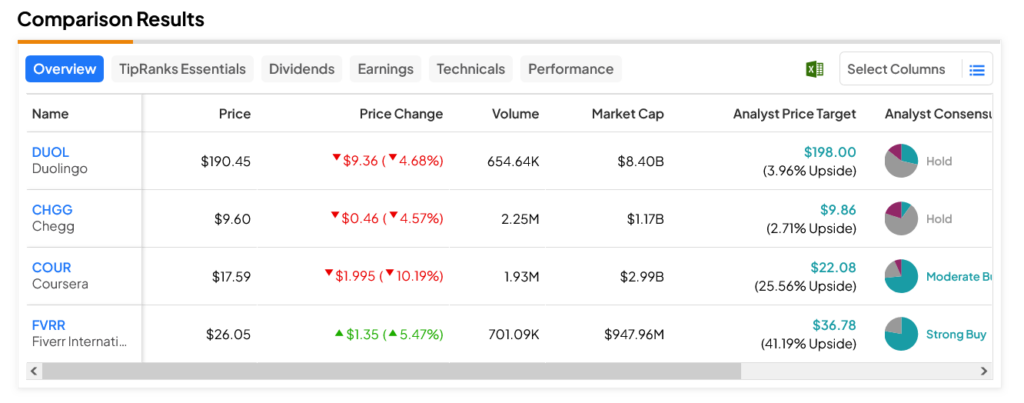

It’s bad news for the educational tech sector, as most of the stocks in that vertical got hammered today following unkind words from Goldman Sachs. Several stocks in the field took hits of various levels, with Chegg (NYSE:CHGG) and Duolingo (NASDAQ:DUOL) down over 4.5% each. Meanwhile, Coursera (NYSE:COUR) plunged over 10%. The notable exception was Fiverr (NYSE:FVRR), which managed to blast up over 5% in the Friday afternoon session.

So, what happened to this entire sector? Word from Goldman Sachs happened, and the word was definitely not welcome. The actual word was “AI,” and what artificial intelligence would likely do to educational technology in the process. Analyst Eric Sheridan spelled out the bad news: the rise of generative AI will probably fundamentally alter the behavior of learners out there, and it’s not immediately clear how educational technology will—or even can—respond to this.

Despite a legion of schoolmarms out there clucking their tongues and wagging their fingers, it’s a safe bet that most essays from now on will be at least partially written by AI. Fiverr, meanwhile, managed to swing an upgrade at Goldman Sachs, going from Neutral to Buy thanks to “…increased levels of personalization,” among other key factors.

A Change Whose Extent No One Can Tell

Uncertainty is likely to work hard against educational tech companies going forward, and the word from Goldman Sachs makes that pretty clear. Indeed, one report just from November suggests that there are five different areas of learning—language learning, writing, early childhood education, tutoring, and even teaching—that AI can make an impact on. That’s a threat to pretty much the entire concept of education, and with that in mind, there’s little wonder why the entire New York City school system banned ChatGPT outright. Though just how far that ban can extend past the schoolyard gate is anyone’s guess.

Which Educational Technology Stocks are a Good Buy Right Now?

Turning to Wall Street, the clear laggard in the sector is Hold-rated CHGG stock, which can only muster a 2.71% upside potential against an average price target of $9.86. Meanwhile, FVRR stock, a Strong Buy, is a clear leader with a 41.19% upside potential on a $36.78 average price target.