E-commerce major eBay Inc. (NASDAQ: EBAY) has reported better-than-expected results for the fourth quarter ended December 31, 2021.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, following the earnings, shares of the company declined 7.8% to close at $50.35 in Wednesday’s extended trading session.

Revenue & Earnings

eBay reported quarterly net revenues of $2.61 billion, up 5% from the same quarter last year and in line with the consensus estimate.

The company’s quarterly earnings of $1.05 per share rose 24% year-over-year and outpaced the consensus estimate of $0.99 per share.

Other Operating Metrics

eBay’s Gross merchandise volume (GMV) witnessed a de-growth of 10% from the previous year on an as-reported basis to $20.7 billion.

Moreover, annual active buyers and annual active sellers declined 9% and 8% year-over-year to 147 million global active buyers and 17 million global active sellers, respectively.

Notably, the company’s operating margin also witnessed a slight decline to $31.6% from 31.7% last year.

Outlook

For the first quarter of 2022, the company expects to post revenues between $2.43 billion and $2.48 billion against the Street’s estimate of $2.62 billion. Further, it anticipates EPS in the range of $1.01 to $1.05 per share versus the consensus estimate of $1.10 per share.

For full-year 2022, EBAY forecasts revenues in the range of $10.3 billion to $10.5 billion against the consensus estimate of $10.95 billion. It further anticipates earnings of $4.20 to $4.4 per share against the consensus estimate of $4.51 per share.

CEO Comments

The CEO of eBay, Jamie Iannone, said, “Rounding out a very strong year, I’m proud of our team for delivering yet another solid quarter. By investing in our strategy to drive sustainable growth, we increased customer satisfaction, improved the seller and buyer experience, and returned value to our shareholders. During the quarter, we completed our multi-year payments transition, and generated growth in both our advertising business and focus categories. As we continue to accelerate our strategy, we are well positioned for future growth.”

Stock Rating

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 6 Buys and 5 Holds. The average eBay price target of $74.55 implies that the stock has upside potential of 36.6% from current levels. Shares have declined 8.1% over the past year.

Website Traffic

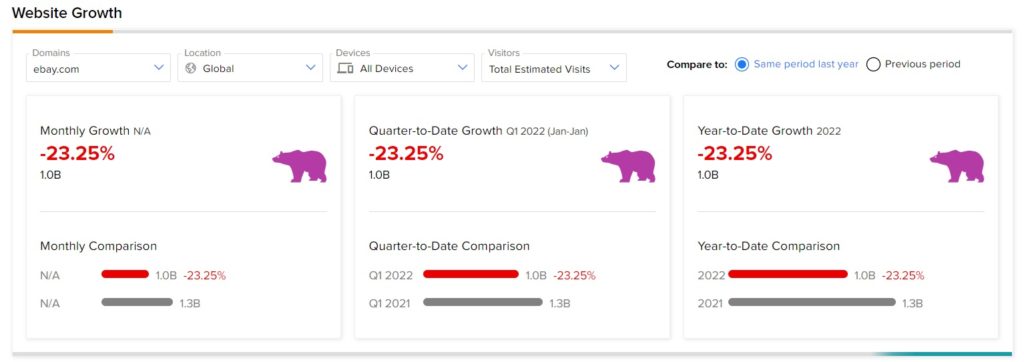

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into eBay’s performance this quarter.

According to the tool, year-to-date, the eBay website traffic recorded a fall of 23.25%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Palo Alto Networks Beats Q2 Expectations; Shares Up 6.4%

MercadoLibre Pops 9.5% on Strong Q4 Results

U.S. Bancorp Collaborates with Microsoft