It is a tremendous day to be a shareholder of e-commerce platform Shopify (TSE:SHOP) (SHOP). Why? Because shares are up over 22% in Wednesday morning’s trading thanks to an outstanding earnings report that knocked expectations so far out of the park that they ended up in an entirely different sport. Shopify brought in $0.26 per share in earnings versus projections calling for $0.20. Revenue, meanwhile, also posted a beat, bringing in $2.05 billion compared to estimates of $2.01 billion.

One of the biggest wins for Shopify came when it launched Shop Week back in June, a shopping event that saw Shopfiy merchants turn out in droves with discounts. Over 10,000 of said merchants ended up turning in their best week ever by gross merchandise volume (GMV), and Shopify even noted that “cross-border sales” made up around 14% of the total GMV. Merchants, according to company president Harvey Finkelstein, were eager to get access to global markets.

The Obvious Problem Does Not Apply

This is where things get interesting. The obvious problem for Shopify is souring overall consumer sentiment. With people buying fewer things in general as they watch their budgets more closely, particularly with rising prices at the grocery store and gas pump, it would be easy to think that Shopify would fall prey to this itself.

However, that simply is not so. Citi analysts, who kept a Buy rating in place, noted that “…SHOP delivered a very solid Q2 with top-line trends continuing to see more resilience vs. peers.” And with third-quarter growth expected in the low-to-mid 20s percentage range, it looks like Shopify customers will keep right on buying.

Is Shopify a Buy or Sell?

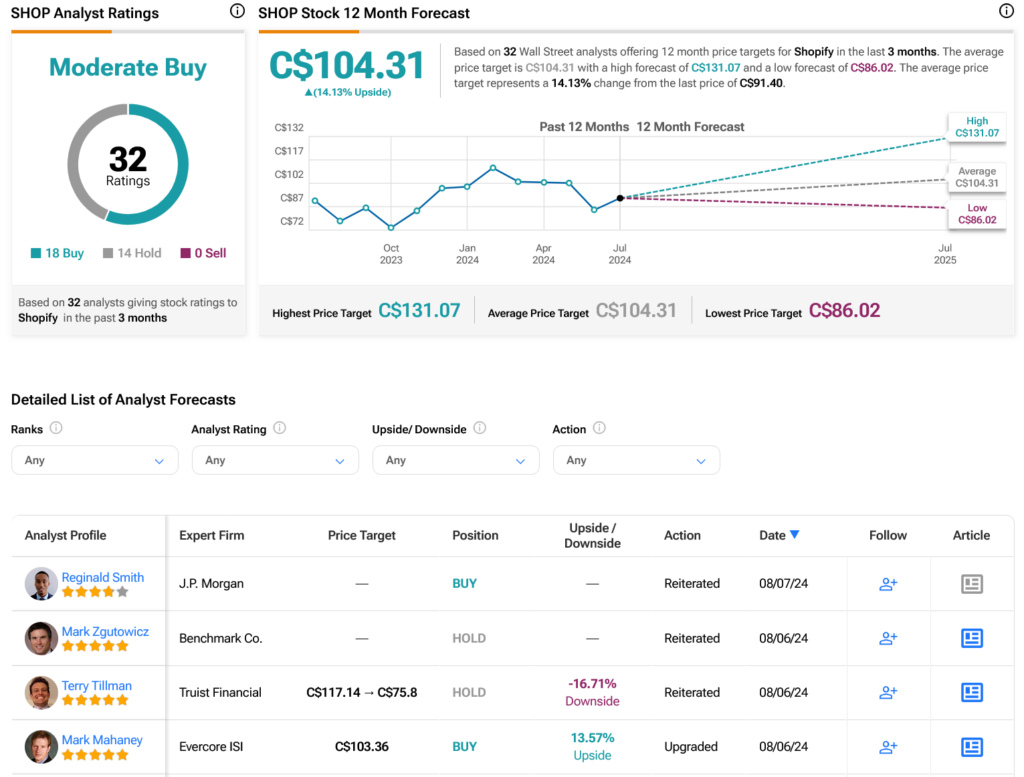

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:SHOP stock based on 18 Buys and 14 Holds assigned in the past three months, as indicated by the graphic below. After a 20.8% rally in its share price over the past year, the average TSE:SHOP price target of C$104.31 per share implies 14.13% upside potential.