Duolingo (NASDAQ:DUOL), the firm behind the incredibly popular gamified language-learning app, has been a choppy mover in the past year, plunging and spiking by more than 25% on multiple occasions. It’s as though you can see where the earnings reports are just by looking at the stock chart. As the company infuses more generative AI into its “sticky” platform, investors might want to hold on as this underrated AI beneficiary advances language learning into the technological age. All things considered, I remain bullish on DUOL stock.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I’ll admit that I was quite skeptical about shares of DUOL when they went live on the public markets back in the summer of 2021. But the app makes it so incredibly fun way to learn a language. The app single-handedly shows us that entertainment and learning can be rolled into one. Perhaps more remarkably is how well the company has kept users “engaging” with its platform over extended periods of time.

Dulingo’s a Master at Keeping Its Users Engaged

Arguably, Duolingo does “streaks” better than most other apps. How many times have you heard a Duolingo user pulling out their smartphone five minutes before midnight and telling you they need to do a quick lesson to keep their streak alive? If meditation apps could get users to keep their streaks going, we’d probably all have found enlightenment by now. In any case, Duolingo has many growth levers it can more effectively use with a user base that is not just “sticky” but consistently engaged.

Whenever you can command respectable daily active users (DAUs), as Duolingo has with more than 31.4 million DAUs at the end of the first quarter (up 54% year-on-year), you can upsell them on intriguing, tech-driven new services. Though the ad-based tier is robust, I see the most opportunity for the firm to bring aboard users to its Duolingo Max plan.

Apart from getting rid of those ill-timed, pesky ads that pop up between lessons, Duolingo Max offers an AI experience driven by the power of OpenAI’s ChatGPT-4. Sure, you could use GPT-4 or any other free large language model to chat in a new language. Arguably, GPT-4o, which better allows for fluid conversations, may represent the next frontier in how we communicate with AIs, regardless of language.

That said, I’d argue that Duolingo isn’t at risk of obsolescence from such a powerful AI model. Rather, it could be a massive beneficiary as it tailors the best of what ChatGPT has to offer for an effective, gamified, and, perhaps most importantly, convenient and structured way to learn a new language.

As Duolingo Max continues tapping into the power of generative AI, it will be very interesting to see how it structures lessons in the AI age. Perhaps pronunciation, one of the biggest challenges in learning a new language, can be perfected with ChatGPT and Duolingo joining forces.

A Big Bull on DUOL Stock Thinks AI Worries Are Overdone

JMP Securities analyst Andrew Boone believes the “AI threat” is overblown. What’s the perceived threat to Duolingo, you might ask? The rise of real-time language translation may disincentivize learning a new language. Additionally, some people may turn to the language models themselves to chat in another language.

With a $260 price target, which entails around 23% upside from Tuesday’s market close, and a late-May upgrade to Buy, Mr. Boone is just another big-name analyst in the bull camp.

Specifically, Mr. Boone noted, “Computer-powered translation does not replace the connection of conversing with others in another language,” He’s absolutely right. We’ve had translation apps for years, and they’ve been pretty good. However, they lack the human touch. Also, it’s just so awkward and unimpressive to pull out your phone and get someone to repeat something to be translated.

To add to Mr. Boone’s strong point, Duolingo is also fun, perhaps as fun as any mobile game out there. Besides, you also get a strong sense of satisfaction knowing you learned something while having fun. And, of course, let’s not forget about the dopamine hit from starting or extending your streak. The Duolingo owl mascot would surely be proud!

If anything, AI could help Duolingo save money when producing new lessons. Earlier this year, the company laid off some translators. I’d not be shocked if they replaced departed staff with AI.

Is DUOL Stock a Buy, According to Analysts?

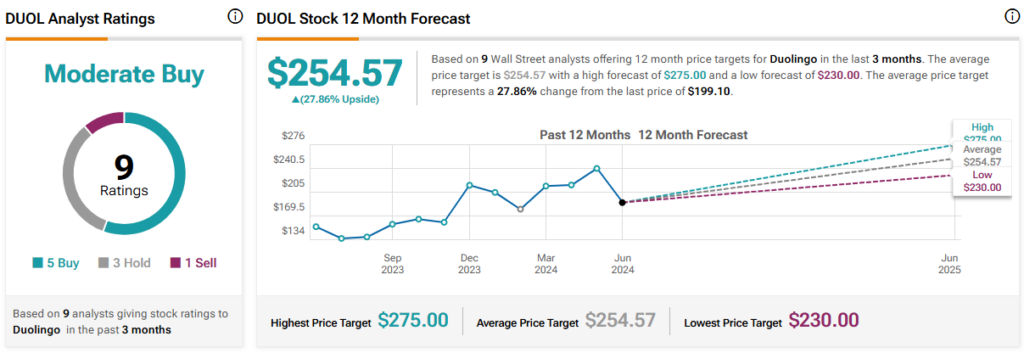

On TipRanks, DUOL stock comes in as a Moderate Buy. Out of nine analyst ratings, there are five Buys, three Holds, and one Sell recommendation. The average DUOL stock price target is $254.57, implying upside potential of 27.9%. Analyst price targets range from a low of $230.00 per share to a high of $275.00 per share.

The Bottom Line on Duolingo in the AI Age

As the AI age takes off, it will be interesting to see how Duolingo evolves. AI may be a double-edged sword, but I view it as a net positive for the firm. With a nice relationship with ChatGPT and the margin-padding benefits of using AI translators, the company already seems to be riding the AI wave. The only question is how high it can ride without wiping out.