Shares of DraftKings (NASDAQ:DKNG) gained about 8% in after-hours trading yesterday. The upside can be attributed to the company’s stronger-than-expected results for the third quarter of Fiscal 2023 and increased full-year outlook. DKNG’s performance benefited from the expansion of its sportsbook and iGaming products into new states and improved promotional activities.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

DraftKings offers a diverse range of online betting and gaming experiences for sports enthusiasts and fans.

Q3 Snapshot

In the third quarter, DKNG’s bottom line swung to profit. Adjusted earnings per share came in at $0.35, which beat analysts’ consensus estimate of a loss of $0.69 per share.

Meanwhile, sales climbed 57.4% year-over-year to $789.9 million. This beat analysts’ expectations of $704.9 million. The top-line growth was driven by new customer acquisition and product innovation, which supported customer retention.

In terms of key metrics, DraftKings saw Monthly Unique Payers reach 2.3 million on average in the third quarter, up 40% from the year-ago quarter. Additionally, the average revenue from those Monthly Unique Payers hit $114, which increased 14% year-over-year.

It is worth mentioning that by Q3-end, DKNG was live with mobile sports betting in 22 states, representing nearly 45% of the U.S. population. Also, iGaming, an online gambling platform, is live in five states.

DraftKings’ Revised Outlook

Based on the solid quarterly performance, DKNG raised its full-year Fiscal 2023 revenue guidance. The company now expects revenue to come in the range of $3.67 to $3.72 billion, up from its previous guidance of $3.46 to $3.54 billion.

Moreover, DraftKings expects its FY23 adjusted EBITDA guidance to fall between ($95) and ($115) million. DKNG also introduced a Fiscal 2024 revenue outlook range of $4.50 billion to $4.80 billion.

What is the Price Target for DKNG stock?

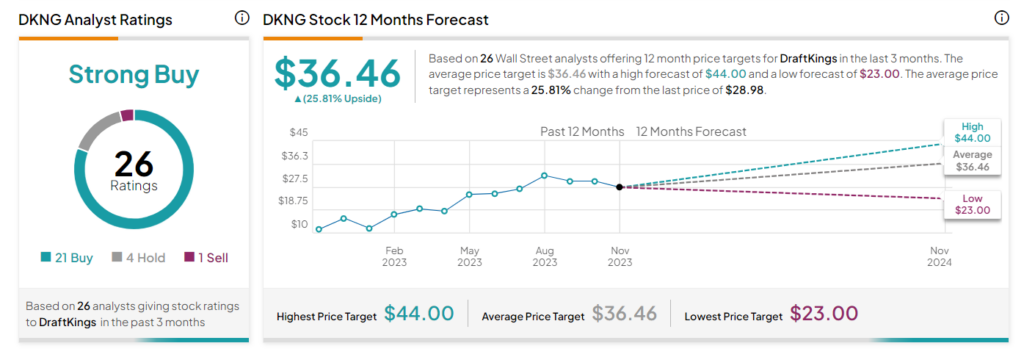

Following the Q3 earnings release, two analysts have maintained a Buy rating on DKNG stock. Further, Deutsche Bank analyst Carlos Santarelli reaffirmed a Hold rating on the stock.

On TipRanks, DraftKings stock has a Strong Buy consensus rating based on 21 Buys, four Holds, and one Sell. The average stock price target of $36.46 implies a 25.8% upside potential. The stock is up more than 162% so far in 2023.