Morgan Stanley (MS) analyst Stephen Grambling cut the price target for DraftKings (DKNG) to $47 (49.5% upside) from $51, while maintaining a Buy rating. This revision came after DKNG lowered its full-year 2024 EBITDA (earnings before interest, taxes, depreciation, and amortization) guidance, raising concerns about the company’s bottom-line performance.

It’s important to highlight that DKNG stock gained 5.3% on Tuesday’s trading session. Before delving deeper into the analyst’s opinion, let’s take a quick look at the company’s Q2 performance.

DKNG’s Q2 Results

The company delivered strong revenue growth of 25.7% in the second quarter, driven by increased customer engagement. Additionally, adjusted earnings per share of $0.22 increased from $0.14 in the prior-year quarter.

However, for the full year, DKNG revised its adjusted EBITDA forecast to $340 million to $420 million, down from the previous range of $460 million to $540 million.

Analyst’s Opinion

While acknowledging DraftKings’ strong revenue growth, the analyst expressed concerns about its sustainability because of the company’s disappointing profit margins.

As a result, the analyst lowered his EBITDA estimates due to weaker profitability from higher customer acquisition costs. Although Grambling remains impressed by the company’s revenue figures, he anticipates continued pressure on the bottom line.

What Is the Price Target for DKNG Stock?

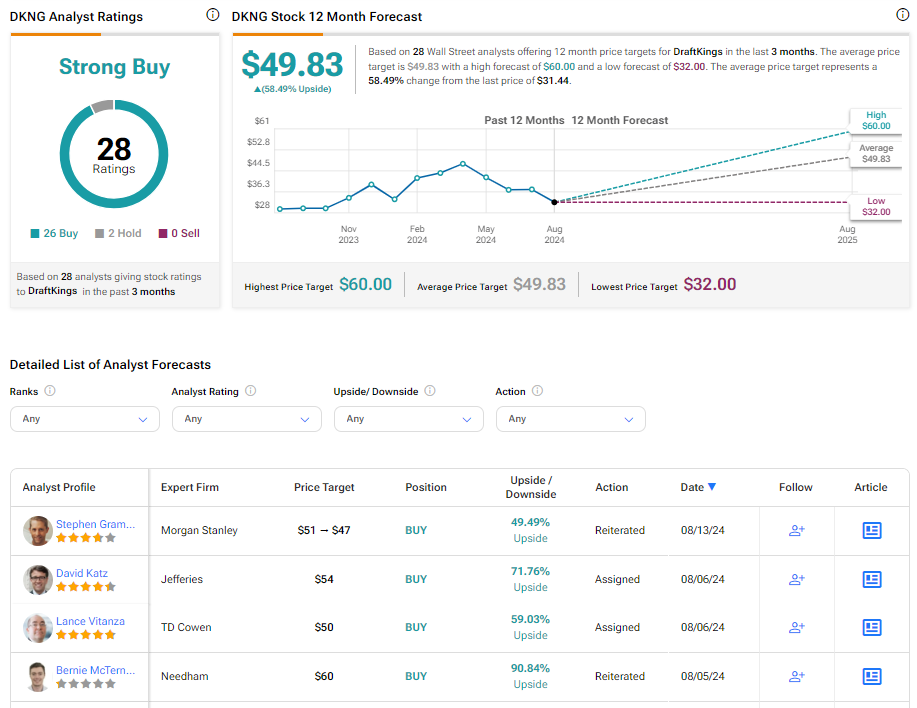

After a 29% decline in shares of the company in the past three months, the analysts’ average price target on DraftKings stock of $49.83 implies a 58.5% upside potential from current levels.

Based on analysts’ consensus ratings, the stock sports a Strong Buy consensus rating, reflecting 26 Buy and two Hold recommendations.