Domino’s Pizza (DPZ) shares plunged by nearly 13% in the premarket session today after the global pizza giant reported mixed numbers for the second quarter and issued a dismal outlook.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Domino’s Q2 Numbers

Revenue increased by 7.1% year-over-year to $1.09 billion. However, the figure missed expectations by $10 million. The company’s EPS of $4.03, on the other hand, fared better than estimates by $0.35.

During the quarter, Domino’s U.S. same-store sales growth came in at 4.8%, but its international same-store sales growth remained at a modest 2.1%. The company increased its total store count by 175 to 20,930 stores in Q2. At the same time, DPZ’s gross margin for owned stores in the U.S. contracted by 100 basis points to 17.6% due to higher labor costs. Still, its net income improved by nearly 30% to $142 million.

Dismal Outlook

While Domino’s Q2 performance displays resiliency in the current challenging macroeconomic environment, the company’s outlook seems to be weighing on investor sentiment today.

Domino’s plans to open 175+ net new stores in the U.S. annually between 2024 and 2028. However, it expects to miss the goal of opening 925+ net new stores in international markets this year by a margin of 175 to 275 outlets. This setback stems from challenges at Australia’s Domino’s Pizza Enterprises (DMP). Additionally, DPZ is suspending its guidance of 1,100+ global net new store openings until the complete effect of challenges at DMP becomes known.

Is Domino’s a Buy, Sell, or Hold?

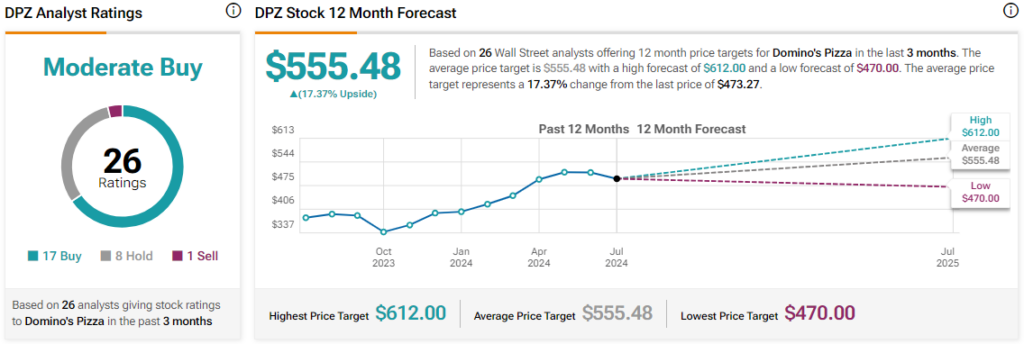

Today’s price decline comes after a nearly 22% rise in Domino’s share price over the past year. Overall, the Street has a Moderate Buy consensus rating on Domino’s, alongside an average DPZ price target of $555.48. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure