The U.S. Department of Transportation (DoT) has started an investigation into the rewards programs of the nation’s four largest airlines. This includes Delta Airlines (DAL), American Airlines Group (AAL), United Airlines Holdings (UAL), and Southwest Airlines (LUV).

Details of the Transportation Department’s Investigation

To better understand the focus of this investigation, the department aims to look at how these programs impact consumers, focusing on issues such as the reduction in value of earned rewards, hidden or dynamic pricing, extra fees, and reduced competition. As part of this process, the department has requested detailed reports and data from the airlines.

In explaining the rationale behind the investigation, Transportation Secretary Pete Buttigieg noted, “Many Americans view their rewards points balances as part of their savings. But unlike a traditional savings account, these rewards are controlled by a company that can unilaterally change their value.”

Why Are Loyalty Programs Being Probed?

The context behind the probe shows that, over the past few months, loyalty programs have faced growing criticism, with the Biden administration and lawmakers expressing concern that airlines entice customers with attractive rewards, only to reduce the value of those perks without notice. There are also concerns that these programs may give large carriers an unfair advantage over smaller competitors. This investigation targets a key revenue stream for major airlines, which are earning billions from loyalty programs and co-branded credit cards.

To illustrate the scale of these programs’ profitability, according to a Bloomberg report, Delta earned $6.8 billion in 2023 from its credit card partnership with American Express (AXP). This number is expected to grow by 10% this year and eventually reach $10 billion. Similarly, American Airlines received $5.2 billion in 2023 from its co-branded credit card and other partners.

The value of these programs became particularly evident during the COVID-19 pandemic when major US carriers secured over $20 billion in financing by using their loyalty programs as collateral.

How Do Airline Loyalty Programs Work?

These loyalty programs work by airlines generating revenue through the sale of points or miles to their co-branded credit card partners. These credit card partners, in turn, offer them as rewards to cardholders when they make purchases on the card. Additionally, credit card companies can sell points or miles directly to consumers or other businesses, including hotels, retailers, and car rental companies.

Which Is the Best Airline Stock?

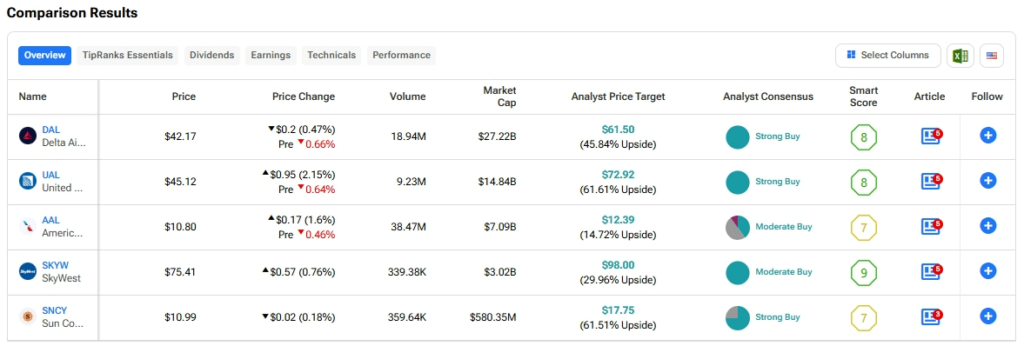

We used TipRanks’ Stock Comparison tool to find the best airline stocks and filtered for those with a Strong Buy or Moderate Buy consensus rating from Wall Street analysts. Based on the results below, these are the top airline stocks to buy, according to analysts.